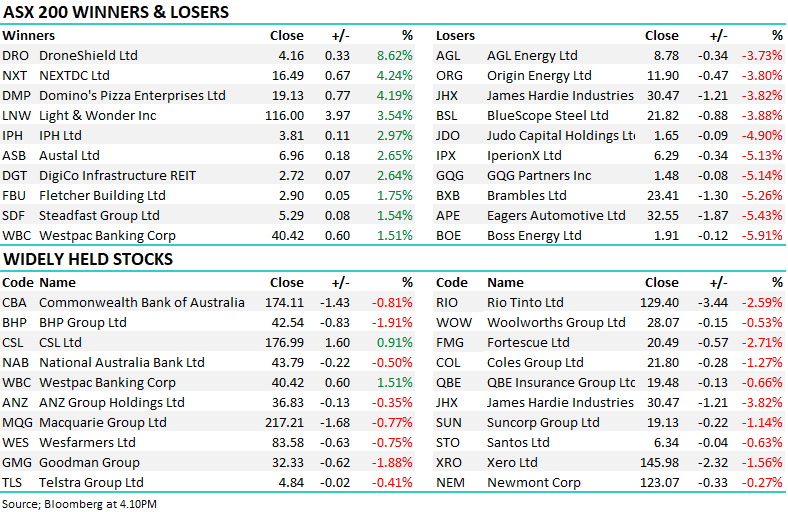

In August WOW reported earnings that were slightly ahead of expectations, a special dividend, higher than expected margins, and good sales momentum to start FY25 – a great combination. However, the stocks fallen ~10% since its initial euphoric spike higher. The issue, as we all know, is a month ago the ACCC accused them of telling shoppers they had dropped prices when they had actually increased them sharply beforehand – extremely sneaky at best. As we’ve said previously it reminds MM of when the banks came under regulatory scrutiny before COVID but they’ve rallied substantially from their lows after the Royal Banking enquiry 2017-19 – its all in the timing!

WOW is trading on the cheaper side of history but not compellingly so, considering the potentially huge fine and limitations on pricing methods moving forward. Documents filed with the Federal Court show new details of alleged fake discounts by COL and WOW, which could be far worse than first thought. With an election on the horizon these companies are in the wrong place, at the wrong time.

The recent result for Star (SGR) was favourable for the business but any tougher they were gone, that is not the case for WOW and COL. Precedent determines most things in law, in August the ACCC issued a fine of almost $11mn on Secure Parking for misleading customers but they’re small fry compared to WOW which made over $1.7bn last year – once you’re in the regulator’s crosshairs, it will cost money—the only question is how much! Prime Minister Anthony Albanese rapidly made the investigation a political hot potato by announcing the government would legislate a mandatory code of conduct on supermarkets.

- We could see WOWs fine surprising on the upside, especially as they can afford it, hence we want WOW closer to $30 before considering a position pre-findings.