WOW has endured a shocking year; if they could get it wrong, they have, a fact which saw Amanda Bardwell become CEO in September. With a recent underwhelming trading update and ongoing uncertainty around the ACCC, investors remain comfortable avoiding the Australian household name. However, as followers of the market know, things usually look/feel their worst when stocks are close to a low, which could be true for WOW in 2025.

NB The final report from the ACCC is due to be released no later than February 28th.

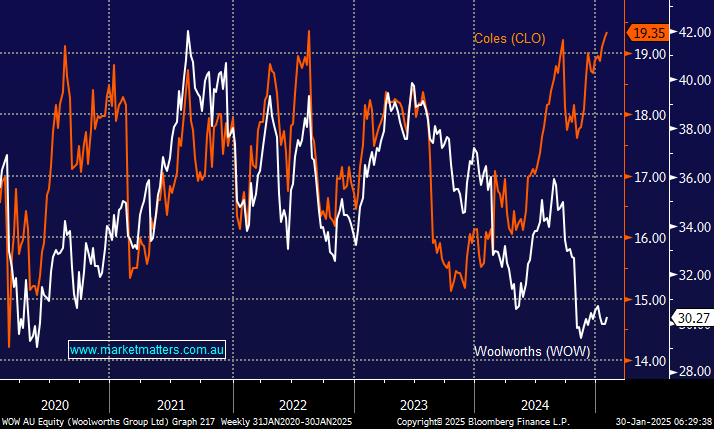

We’ve been stalking WOW over recent months, successfully avoiding it throughout 2024. Many analysts are simply saying buy Coles (COL) for a major supermarket exposure, but we believe that particular elastic band has become extremely stretched. When fund managers decide it is time to rebalance part of their portfolios across to WOW, the move could be relatively dramatic for the often-referred defensive sector.

Successful investing involves plenty of preparation, and in the case of Woolies, MM is looking for a washout on the downside to gain exposure to the embattled supermarket. WOW is forecast to yield 3.8% fully franked over the coming year, which grosses up to ~5%; plus, if we are correct and WOW makes new swing lows in the coming months, this will improve the yield even further.

- We like WOW’s risk/reward ratio in the $28.50 area, or ~4% lower and will consider buying accordingly.