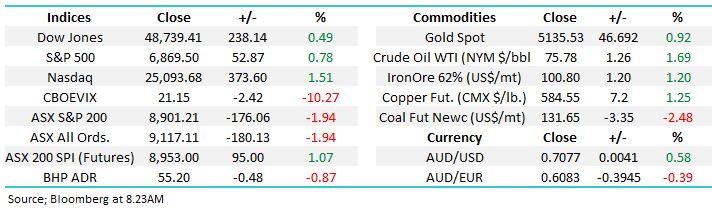

WOW has been in the naughty corner for the last few years. With a recent underwhelming trading update, ongoing uncertainty around the ACCC, and even a class action, investors look comfortable avoiding the Australian household name. However, things/news flow usually look the worst when stocks close to a low, which could be true for WOW in 2025.

WOW traditionally garners a premium valuation relative to the market and its peers, however given current issues, trading on a PE of 22.1x, WOW is now back to a similar valuation to Coles (COL) on 21.6x and only a touch ahead of the ASX200 more broadly, which is trading on 19.5x. The premium is usually justified given the certainty of their earnings, and better margins relative to COL’s thanks to better distribution, scale and technology. For now, WOW is unloved but we are getting more interested as a high quality defensive stock and certainty around the ACCC could be a catalysts to arrest its decline.

NB The final report from the ACCC is due to be released no later than February 28th.

- We like WOW’s risk/reward in the $28.50 area, or ~4% lower.