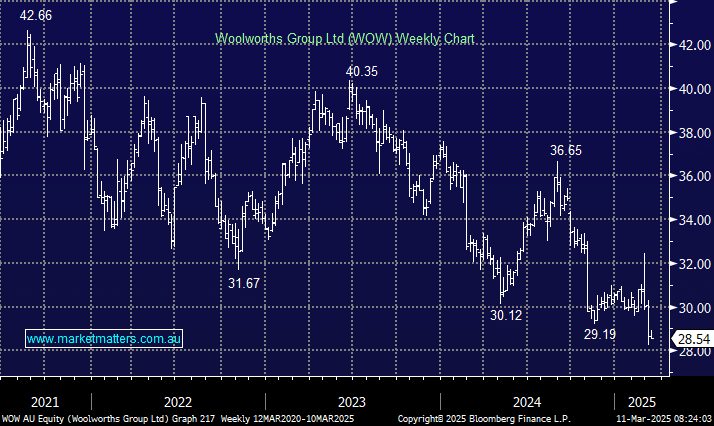

The last few years have been awful for WOW. If they could get it wrong, they have—the stock is down over 30% from its 2021 high, whereas Coles has rallied steadily over the same period. We have discussed WOW pitfalls at length over the last year, avoiding the stock as a consequence, but it’s getting interesting as it falls toward multi-year lows. This underperforming defensive consumer staple should deliver when a defensive stance is warranted.

- We like the risk/reward towards WOW around $28, supported by a sustainable 4.2% ff yield.