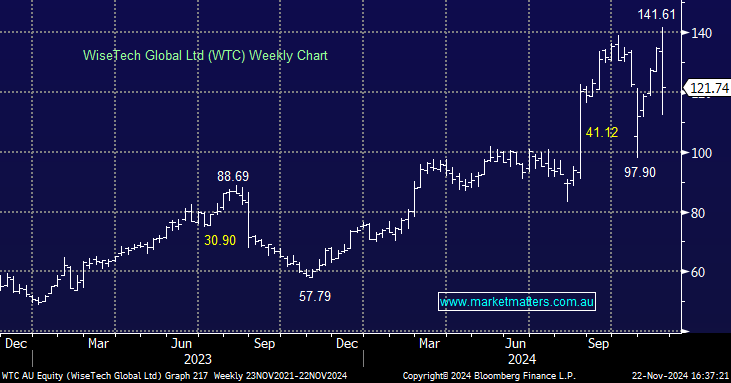

WTC -12.74%: Shares were down as much as 19% at one point after news out of its AGM. The logistics software company cut its earnings guidance for FY25, well below consensus forecasts. When stocks trade at such stretched multiples of their earnings, any slight miss to guided or actual earnings is always a reality check for the share price, and that’s what happened to WTC today.

- 2025 EBITDA forecast cut from $660-$700m to A$600-$660m. Consensus forecast was $684.5m.

The business also announced that a key project had failed to launch due to the noise surrounding now ex-CEO Richard White. Notably, they are still in the process of finding a suitable replacement, this could take some time. We spoke about potential skeletons in the closet for White/WTC in our last note, and we suspect this may not be the last of this saga. Given the volatility of the share price and the current unknowns, we’ll hang on the sidelines for now.