This cloud-based logistics software business has been a standout performer over recent years, and they have clearly executed well, but the big issue for MM comes to valuation as the Richard White scandal deepens by the day. While some of the personal allegations being made are scathing, there has clearly been a questionable board that may not have fulfilled its duty of applying checks and balances. While it’s understandable that the founder, CEO and major shareholder has significant influence, it seems clear the board has allowed White too much free rein.

- While White will have some of the best legal minds in his corner, this is going to be a difficult position to come back from, in MM’s view.

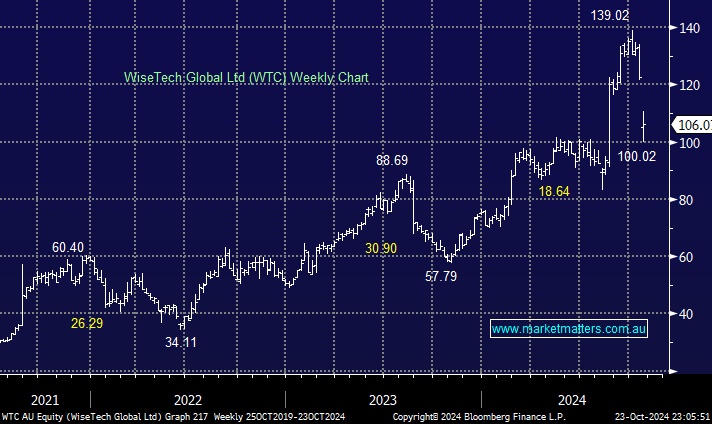

When companies are executing well as WTC has, valuations continue to grow – the market is simply happy to back growth at any price i.e. the concept of being priced for perfection. When something from left field hits a company on such a significant valuation, the moves can be significant, simply based on a re-rate lower of the earnings multiple, irrespective of the actual earnings impact.

WTC’s products are very engrained in the logistics supply chain, and that means we’re not likely to see a near term earnings impact, however, the stock is priced for the future and we think these scandals and the incredible pressure now focussed on the board of WTC will continue to gain attention and will ultimately have an impact on the markets view of future earnings.

- We believe the CEO’s position is tenuous as new details/claims emerge.

This creates a risk given there is no one who knows this aggregation of technology products like White. It’s a complicated business, built through acquisition, and it seems like the board has engaged in more of a spectator type role.

- Ultimately, we think WTC above $100 is expensive considering the current uncertainty.

If WTC just gets re-rated back towards its 2023 valuation, a lot more downside is possible, hence for now we are comfortable observers as this situation evolves, it’s not time to be a brave contrarian yet in our opinion.

- We like WTC as a business but growth and price hikes will be harder in the foreseeable future after this recent scathing press.