This week, Webjet, which housed a business-to-consumer platform (www.webjet.com.au) + a couple of other consumer brands, and a business-to-business platform (www.webbeds.com.au) parted ways. WEB shareholders received 1 new share in WJL while retaining a share in WEB, with the combined value worth roughly the same amount.

The ‘new’ WEB is a technology company that connects hotels and other travel sellers to a network of trade-only travel buyers around the world via a digital marketplace. Post-spin-off, WEB has a market capitalisation of $2.7bn. The smaller component is now Webjet Group (WJL) – the B2C business with a market capitalisation of just ~$340m.

The rationale for the spin-out is that each business component can be valued separately. In other words, the more highly valued B2B operation can attract a higher earnings multiple without being dragged down by the B2C operation, which should attract a lower multiple.

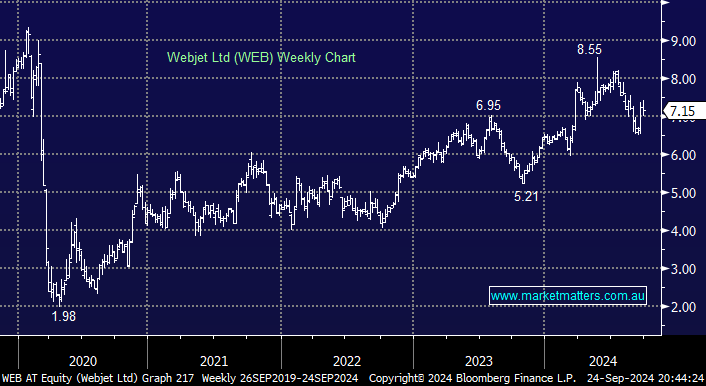

We like the WEB business, and while trading has been on the softer side to start FY25, that’s also been the case across the broader travel sector globally. While we’re working through the additional costs that will be born from the WEB side and trying to get around how the growth pathway will evolve over the coming 5-years (WEB thinks they can grow at 2x the pace of the market), the shares are now approaching levels that look attractive from a risk/reward perspective.

- We have WEB in the Hitlist for the Emerging Companies (& Growth) Portfolios.