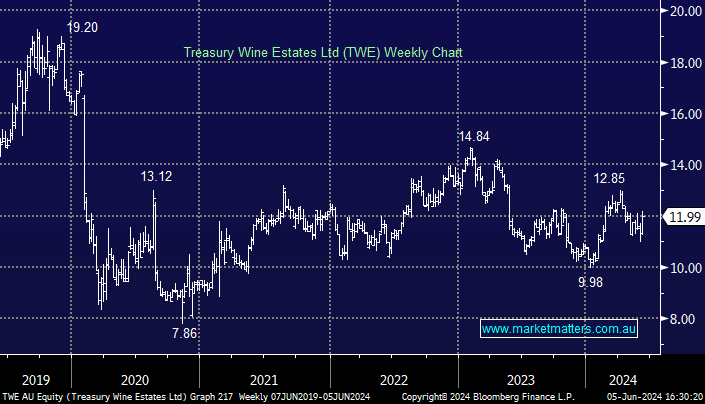

TWE +5.27%: the wine producer and distributor is hosting an investor day at their newly acquired DAOU site in Pao Robles, California, hoping to alleviate some concerns that have followed the $US900m acquisition. In the detail, the company reaffirmed FY24 guidance of mid to high single-digit EBITS growth, broadly in line with consensus expectations of ~6.5% growth. There was downside risk priced in to the stock though given the challenges facing the US wine industry. Early signs suggest Treasury’s distribution model has helped drive growth since the acquisition was completed in December last year with plenty of additional revenue and cost synergies still to come out of DAOU.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

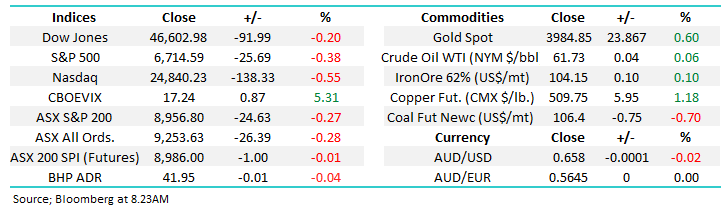

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is long and bullish TWE

Add To Hit List

Related Q&A

Treasury Wine (TWE), Lynas (LYC) and Hybrids

Your opinion on 3 stocks please

Treasury Wine (TWE) and 29Metals Ltd (29M)

Queries on Coronado Global Resources (CRN) and Treasury Wine (TWE)

Your view on various stocks

Your opinion of several stocks

Your assesment of several stocks

Thoughts on China re wine, solar & resources

Thoughts on Treasury Wines (TWE) post the cap raise

TWE

Thoughts on TWE and GEM?

What are MM’s thoughts on TWE?

Stocks to lighten as I increase cash

MVF, COH, MQG & TWE

What’s your target for TWE?

Airlines & TWE

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.