TWE plumbed levels not seen since 2020 on Tuesday after the company announced its current CEO will depart in September to be replaced by the very experienced Sam Fischer. However, as is the trend at the moment, most news is being interpreted as bad news for stocks that have struggled through 2024/5; TWE is down over 27% year-to-date following the company’s downgrade in February. With change comes uncertainty, and in this case, there’s the risk of another downgrade, clearing the decks to provide the incoming CEO with the opportunity to deliver over the coming years.

Australia’s premier wine business has been caught in the crosshairs of global disruptions for years; it feels like it deserves a break!

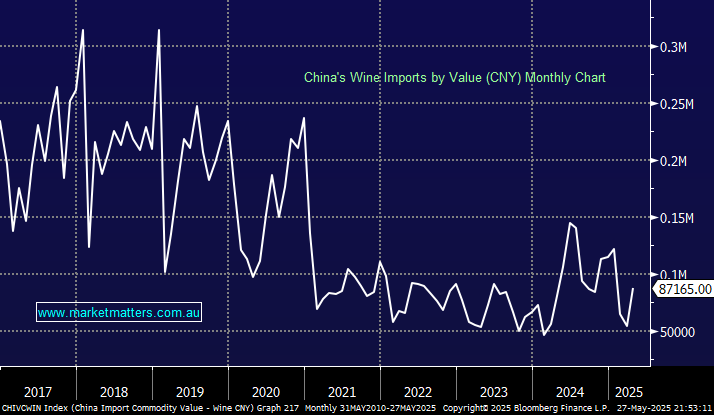

- China imposed massive tariffs on Australian bottled wine in March ’21 – these were lifted in March’24: exports to China from Australia collapsed from $1.24bn in 2019 to $1mn.

- Now we have the risks of further trade ructions with Trump 2.0, creating massive uncertainty across many industries, not just wine.

Trump aside, China is now the new growth area for TWE, following its refocus on the US and the premium wine segment in response to a global wine glut and China’s closed doors. China’s wine consumption looks to be lifting in line with the country’s overall economy, and TWE is looking to gain a piece of this massive pie:

- TWE’s China mainland value growth showed promise in the March quarter, albeit from an almost zero base.

- Unfortunately, at the same time, exports to the United States have slipped as Wine Australia noted; in the US, total wine sales volume is down 7% in the 12 months ended Dec’24 as per SipSource. Recent political and economic turmoil is adding to the market uncertainty in the near term.

Looking further ahead, assuming the world continues to drink wine, TWE is well-positioned, having established a solid business model in the US, and with China reopening, it no longer has all its eggs in one basket.

With TWE set for a transition period the stocks likely to drift lower until some meaningful news renews buyer interest, but this can bring opportunity. The change in management has already led to a couple of broker downgrades but they could be late to the party with the stocks already trading on a “bargain basement” valuation compared to recent years, plus the ~4.7% part-franked yield helps patient investors. At this stage, we believe TWE is “looking for a low,” but there is currently no catalyst to change the trend. However, if/when it tests the psychological $8 area, it will attract our attention with plenty of bad news baked into the share price.

- We see upside in TWE when the market at least diversifies away from the “Certainty Trade”.