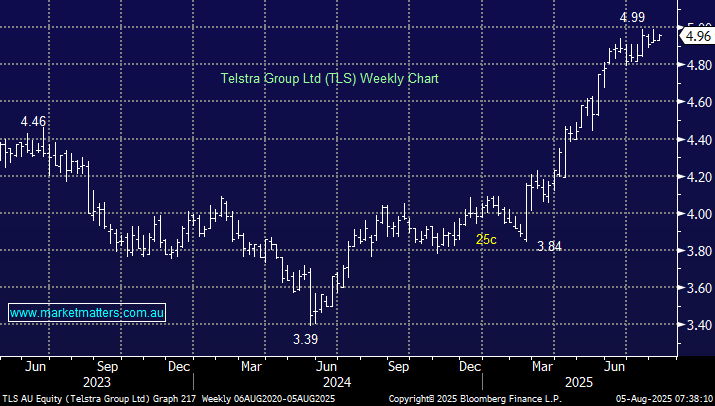

Telstra (TLS) offers a blend of modest earnings growth, solid yield, and capital returns via buybacks, though valuation is starting to look less compelling near $5. After years of stagnation despite rising earnings, the market is now rewarding TLS with a higher multiple, reflecting renewed optimism. Its recent partnership with SpaceX to deliver satellite-powered text messaging in remote areas highlights its technological leadership and evolution from a legacy telco into a more innovative player. It all comes down to valuation, TLS isn’t on our radar at $5 while we are bullish, BUT if/when we decide to be more defensive, we may be more flexible.

- We believe TLS offers good risk/reward back around the $4.50 area – it’s forecasted to yield more than 4.4% over the coming year.

NB We recently took profit on our TLS position in our Active Income Portfolio on valuation grounds: Alert.