Telstra is often considered the quasi perfect defensive play on the ASX but we believe its got far more going for it in the coming years. The Telco giant is forecast to yield 4.0% fully franked over the coming 12 months, with its next dividend due in August. This remains relatively attractive when the business is humming along nicely and the RBA is expected to cut the cash rate this year to 3%. Back in February, TLS delivered a good result, including an increased interim dividend and a $750m on-market buyback. We see scope for upside in mobile, AI, and further capital management, with the company enjoying pricing power in the mobile market due to its dominant market position; TLS accounts for well over 40% of the Australian mobile market.

TLS is at the forefront of technology in its space, having just announced it’s the first local telecom provider to enable customers to send and receive text messages in areas without mobile service, through its partnership with Elon Musk’s SpaceX and his Starlink satellites. This represents a significant step forward for individuals in remote and regional areas where mobile reception is limited. We have no doubt the competition will follow soon, but this is a case in point that the fresh TLS is evolving from the sleepy telco behemoth of old.

Last month, Telstra’s CEO, Vicki Brady, highlighted its five-year plan that would solidify the country’s largest telecoms company as an infrastructure business, poised to capitalise on the boom in AI and data centres. We liked what we heard from Brady, with TLS enjoying scale and the balance sheet to establish a firm foothold in Australia’s AI evolution. Brady, like us, believes the unrelenting demand for data and connectivity is fuelling “a super cycle of investment in digital infrastructure”. We see TLS as a conservative, solid-yielding AI play, not many of those around! Unlike many forging into the space, TLS are delivering buybacks as opposed to raising capital, illustrating the strength of the telco in this rapidly evolving new field.

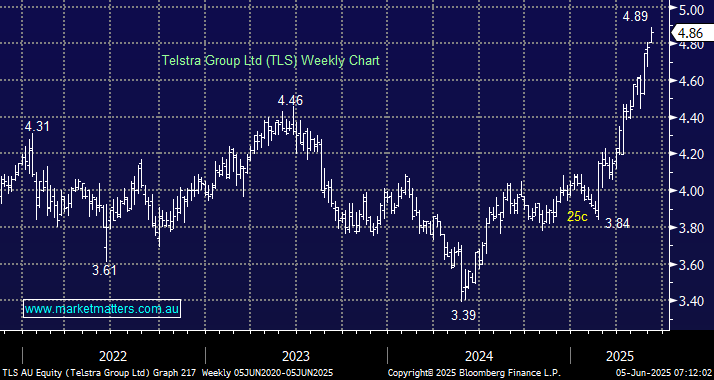

The next 20-25c pullback may see MM considering TLS for its Active Growth Portfolio, especially if it coincides with our timing to adopt a more defensive market stance.

- We are initially targeting a break of the $5 area through 2025: MM holds TLS in our and Active Income Portfolios.