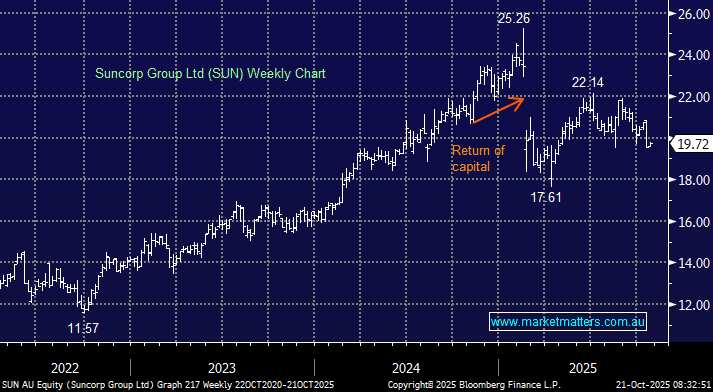

SUN is now a new beast, having sold off its banking arm to ANZ, becoming a pure insurer that can now focus on its proverbial knitting. The stock is trading ~11% below its high post the return of capital to shareholders from the sale of its banking arm. This QLD-based insurer’s FY26 outlook looks solid, with the company saying in August it anticipates gross written premium (GWP) growth in the mid-single digits, supported by the continued earn-through of higher premium rates from prior periods and improved reinsurance market conditions. Plus, it expects the underlying Insurance Trading Ratio (ITR) to be in the top half of the 10% to 12% range, reflecting stronger revenue growth and disciplined cost management.

Suncorp’s revenue is primarily derived from consumer and commercial insurance in Australia, with a significant contribution from its New Zealand operations, while corporate reinsurance makes up a small portion. Key risks include natural hazards, inflationary claims pressures, and potential volatility in the reinsurance and investment markets. However, Suncorp’s FY26 catastrophe reinsurance program provides coverage for losses between $500 million and $6.3 billion, mitigating risks to investors who’ve witnessed several weather events in QLD in recent years. The company is expected to yield 5.2% fully franked in the next 12 months, making it the higher-yielding, more conservative insurance ASX option, in our opinion.

- We like SUN from a value and growth perspective, into the current weakness.