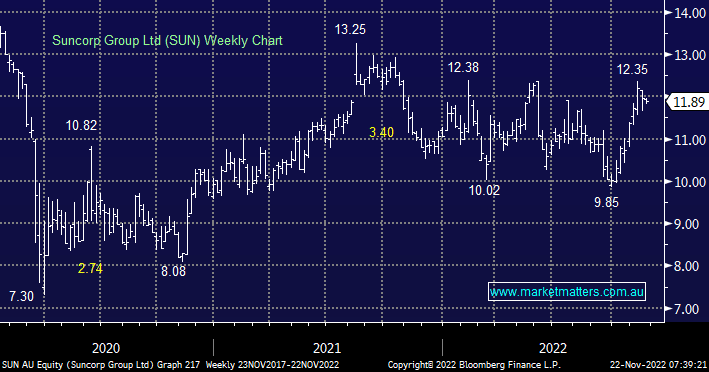

SUN has recovered strongly since dipping under $10 in late September, back in July/August the bank/insurer was in the news for a couple of different reasons:

- SUN disappointed with its full year’s earnings due to rising natural hazards costs – no surprise there, we only have to watch the news.

- ANZ Bank (ANZ) wants to buy the company’s banking business for $4.9bn hence making the performance of its insurance arm even more important.

The stock is forecast to yield 4.8% grossed up over the next 12 months which is attractive with some capital gain but that looks like a coin toss around $12. Interestingly the chart pattern of QBE and SUN is an almost perfect match illustrating that bond yields and natural disasters are driving the share prices at this stage of the cycle.

- We like SUN but the risk/reward isn’t exciting around $12.