The previously much-loved healthcare sector has struggled in 2025, both here and in the US, where last night’s 2.8% fall caught our attention. We currently hold no exposure to the sector in our Active Growth Portfolio, which is a “high conviction” call in itself, with the sector making up around 9% of the ASX200, although CSL is the dominant player. Over the years, stocks in the industry have been taking on an increasingly technical bias, with Pro Medicus (PME), Cochlear (COH), and ResMed (RMD) all notably coming under the umbrella to various degrees. This morning, we looked at SHL, which has an interesting, almost hidden AI arm potentially waiting/hoping to become a meaningful contributor to earnings.

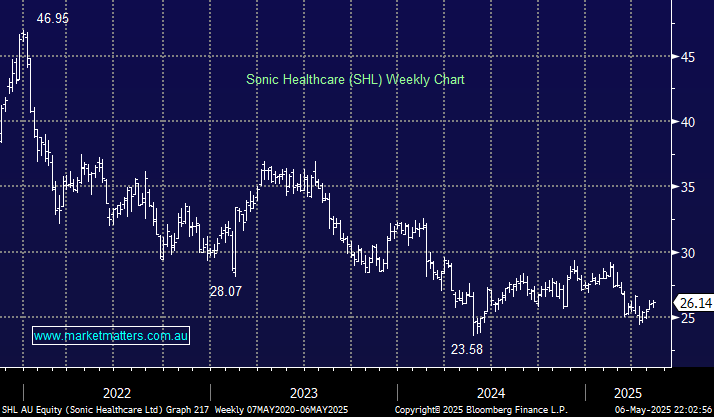

While the ASX200 notched all-time highs in recent months, SHL languishes over 40% below its 2021 high, and almost 20% below its pre-COVID level. The last few years have seen SHL face some significant headwinds with the share price following earnings lower:

- The significant reduction in COVID-19 testing, which previously contributed to high-margin revenues, has led to a painful drop in earnings.

- Rising costs, particularly in labour and operations, have compressed profit margins.

However, Sonic Healthcare remains optimistic about future growth, projecting earnings (EBITDA) of approximately $1.7-1.75 billion for FY2025, as it continues integrating recent acquisitions and makes progress with cost out initiatives. If they can hit these projections, we believe SHL is close to/at the bottom of its cycle.

- For example, many analyst forecasts do not yet include the contributions from the Euro 423mn German LADR acquisition, which is expected to be completed in the next 2 months, and upgrades could be seen moving forward.

Whilst profitability for the sector has improved over the last six months, this trajectory is set to be challenged by uncertainty about reimbursement rates, although the election should help here, and sticky wage inflation. Given the backdrop, we believe the successful execution of company-specific levers will be key in delivering earnings growth for companies across the sector, with SHL well positioned if it successfully beds down recent acquisitions. Debt has increased for SHL following several acquisitions in Germany and Switzerland, but gearing is not worrying, with notable scope for efficiency improvements in the acquired Swiss businesses.

Moving on to its tech/AI interest, which must be put into perspective: SHL’s revenue was $9bn in FY24, and its AI interest only currently generates revenue of a few million. SHL owns 49% of privately owned franklin.ai, an Australian healthcare technology company focusing on developing artificial intelligence (AI) tools to assist pathologists in diagnosing diseases. This company aims to enhance diagnostic accuracy and efficiency. This is an exciting offshoot for SHL that combines Harrison.ai’s expertise in AI technology with SHL’s global clinical experience in medical diagnostics.

- As of January 2025, Franklin.ai reported annual revenue of approximately $3.8 million, which is not a bad start with no debt.

We all know AI is booming, and anybody who can get it right will likely make a fortune. Forbes estimates the Healthcare AI Market is already valued at almost $60 bn, doubling since 2023. We are not suggesting SHL will make a fortune from AI, but there is clear synergy between the businesses and the holding is not being priced into SHL.

- We like SHL, believing it has valuation upside from the successful integration of recent acquisitions, plus its holding in franklin.ai adds a little spice – we have added it to our Hitlist.