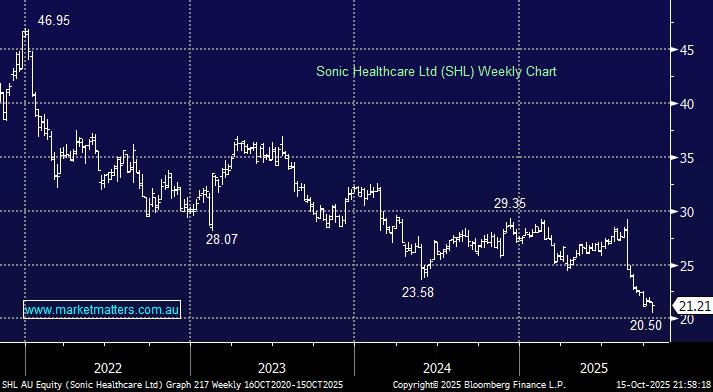

This global medical diagnostics company has struggled for almost four years. We discussed it at length in August Here, adopting a neutral stance and removing it from our Growth Portfolio Hitlist when it was trading ~$24. However, after falling another +10% it caught our eye yesterday, advancing +2.2%, after making fresh five-year lows earlier in the week.

It’s easy to put this stock in the too-hard basket, but like any stock under pressure, it’s worth thinking about what levers they could pull to turn around their fortunes. Pathology, diagnostics, radiology and more general medical facilities & services typically have a lot of fat in them, and we see the adoption of AI efficiencies across through lab automation and service delivery as an avenue for cost reduction.

- While it seems a bit early, we do view SHL as a solid business, and the risk/reward now interesting as a “sleeper” turnaround story, yielding ~5.3%.