We sold out of the salary packaging and novated leasing company ahead of their FY24 results released in February, due to concerns about the prospect of sluggish new vehicle sales (our rationale here). That stance proved to be too conservative, with SIQ reporting well with revenue and earnings ahead of expectations, driving a bigger dividend than we anticipated. We were wrong on the call to sell SIQ, so should we be getting back in?

This is a company we know well, and it is the sort of stock that really suits the strategy we employ in the income portfolio, with consistent growth in earnings at a mid-single digit level, an attractive valuation of 13x and a good fully franked dividend yield of ~6%, with the prospect of special dividends along the way. This stock will not make anyone a fortune, but we think it will be an ongoing beneficiary of increased adoption of EV’s, driven by greater accessibility as consumer options increase and prices come down, with infrastructure improving along with technological developments in battery life and charging capabilities. With EVs being fridge benefits tax exempt, this makes it very attractive to package a new vehicle through SmartGroup (SIQ) or its main competitor, McMillan Shakespeare (MMS)

- The ALP is also very committed to the space, and we expect the continuation and potential expansion of incentives to drive further adoption.

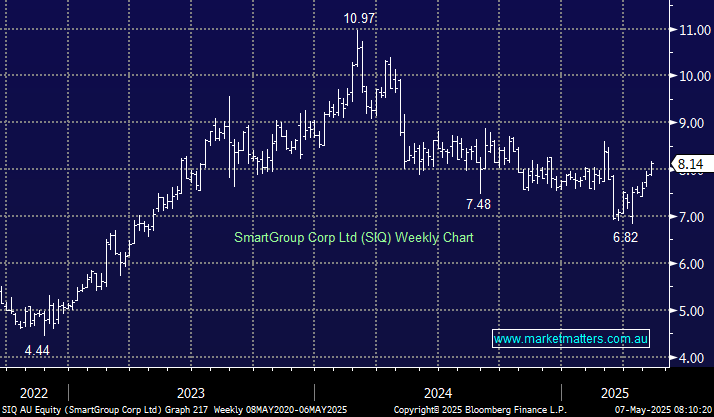

The stock did pull back sharply into the April low, down to $6.80 and has since rallied strongly, back above $8. Our preference is to buy the next period of consolidation, and we’re adding the stock to the Income Portfolio Hitlist.