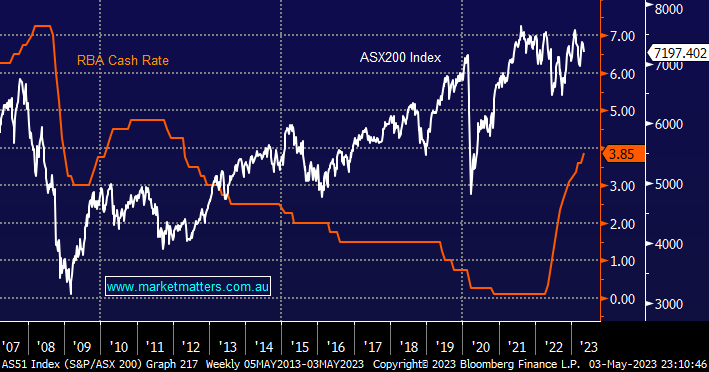

The ASX200 has felt tired over recent weeks, as we’ve been highlighting, but that’s translated to outright vulnerability following a couple of weak sessions on Wall Street and the surprise rate hike by the RBA on Tuesday – recession fears are clearly gathering momentum. At MM we had adopted a more defensive stance into May but after seeing the local index fall over 100 points at one stage yesterday it poses the question of whether we should migrate even further down the risk curve.

- Local stocks feel largely fully valued when we consider the index was trading over 1000 points lower the last time the Cash Rate was at 3.85%.

We are not calling doom and gloom but with rates having ascended so fast and the risks of a recession still very real in simple language it feels like a big ask for the index to punch up towards 8000 after rallying strongly from both its GFC and COVID lows. Hence it makes sense for portfolios to carry an increased level of flexibility if the risk of a pullback has increased.

Yesterday as we watched the market slip away the first thing we did was revisit out Hitlist across the various portfolios to see if value was emerging, particularly in the more defensive names. Today we have looked at 3 defensive stocks that reside on the Hitlist of our Flagship Growth Portfolio.