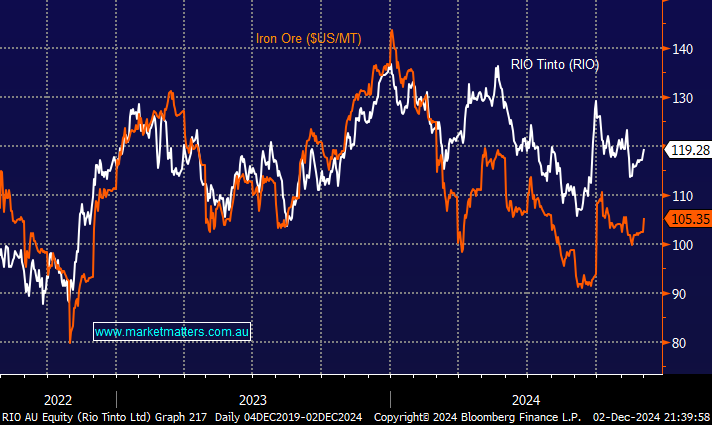

RIO is less than 10% below its October high, outperforming BHP, which has slipped ~12%. However, both are highly correlated to the iron ore price. If iron ore rallies, so will RIO, which generated ~55% of its revenue last year from the bulk commodity. We are bullish on RIO and iron ore stocks into 2025, but they are not for the faint-hearted after several false dawns this year. Beijing’s stimulus is gaining traction, and we can see the market being caught too negatively toward China, especially if we see another salvo of economic stimulus. The key remains the housing activity, with the latest figures showing residential sales fell again in November, reversing the gain enjoyed in October.

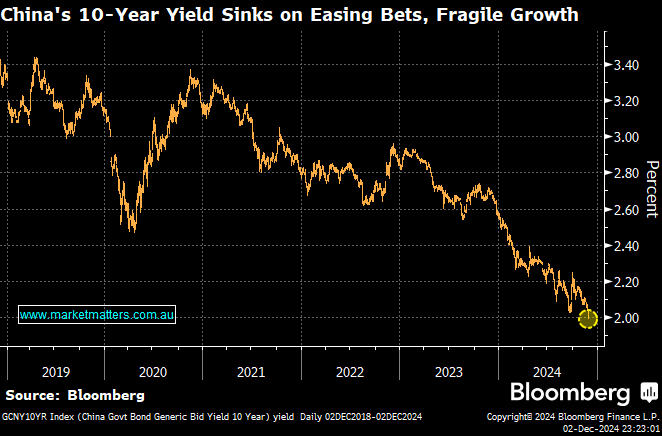

However, China’s 10-year yield dropped for the 5th consecutive week, breaching the key psychological milestone of 2%. It was at a record low as traders ramped up wagers that authorities would ease monetary policy further to bolster the weak economy. The 30-year yield also declined four basis points to 2.16% after falling below its Japanese counterpart for the first time in almost 20-years last month.

China’s credit markets are calling for more economic stimulus to address the housing slump, and we see no reason to disagree.

- We can see RIO initially testing $130 over the coming months.