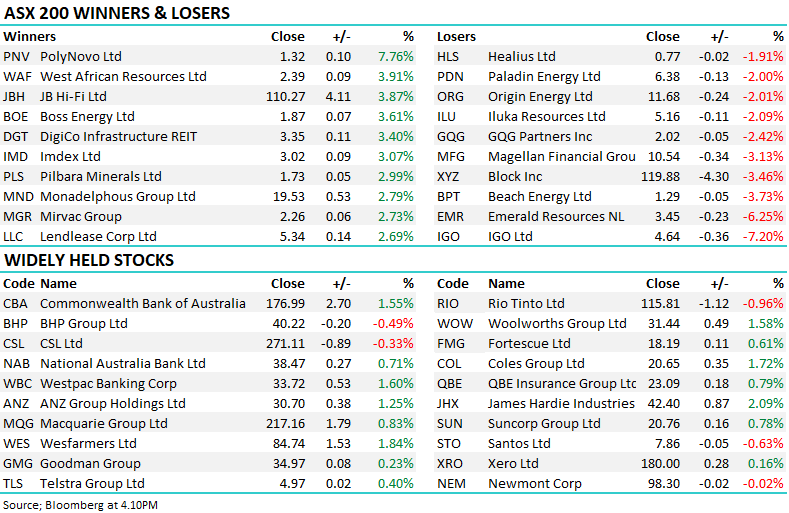

Over recent weeks, RIO has become several analysts’ preferred diversified miner, but when the news around China is this bad, all related stocks basically fall as one. With RIO generating ~56% of its revenue from iron ore in 2023, we see slightly less earnings risk with BHP if the iron ore picture continues to deteriorate further through 2024. Similar to BHP, we believe the stock will start to look attractive, a few % lower – in 2023, when iron ore tested $US98, RIO dipped below $115; today, it’s around 2% lower, similar to the bulk commodity demonstrating the strong correlation to iron ore.

RIO Tinto (RIO) reported at the end of July, and as we said at the time, “Nothing to change the dial here for RIO, with the stock at the mercy of commodity prices, and especially Iron Ore.” – how true that has proved on commodity prices.

- We continue to prefer BHP over RIO, although there’s not much between the two at current levels.