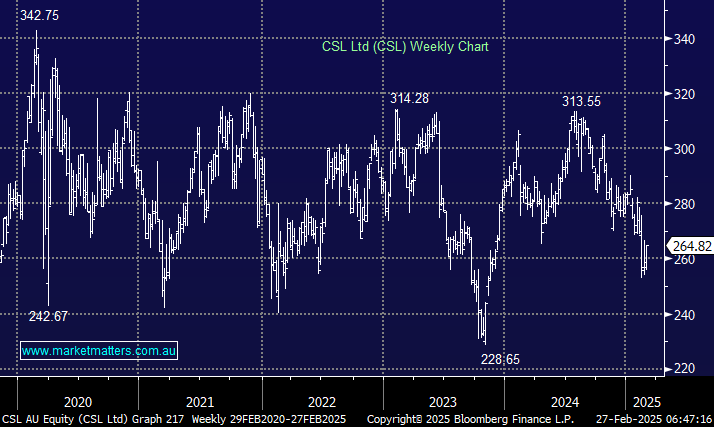

We recently sold CSL and HLS out of the MM Active Growth Portfolio, leaving us with no healthcare exposure to this ~9% sector of the ASX200. Hence, we are carefully looking for attractive risk/reward opportunities in companies in the space we like. Like many sectors of the ASX, the healthcare sector has become very polarised from a performance perspective, with the “old guard” often the laggards; casting our eyes back over the last year illustrates this perfectly:

Winners: Pro Medicus (PME) +173%, Ansell (ANN) +47%, Fisher & Paykel (FPH) +34%, and ResMed (RMD) +34%.

Losers: Ramsay Healthcare (RHC) -34%, Cochlear (COH) -22%, CSL Ltd (CSL) -7%, and Sonic Healthcare (SHL) -4%.

Overnight, we saw the Telix Pharma (TLX) CEO unloading $120mn worth of his large holding in the business. Good luck to him; he has made a lot of people great money in recent years. Notably, the sale was for personal reasons (divorce), and he remains a major shareholder. Fund managers were offered 4 million shares at $29.50, a 4.8% discount to the last trade, a placement that may lead to a little selling across related names this morning. We haven’t covered the biopharma business this morning, but 10-15% lower it will be interesting.

With global markets currently experiencing some performance reversion, we’ve revisited this previously much-revered sector to see if any opportunities are presenting themselves. CSL is the ASX200’s third largest stock and has made a very positive contribution to portfolios over the last decade, but it has been a different story since COVID as the $128bn blood plasma giant struggles with its Vifor acquisition. With an ageing population delivering a clear tailwind to healthcare, it should be like shooting fish in a barrel. However, as we can see above, it’s not; companies must still execute in today’s rapidly evolving world.

- Following last week’s weaker and more complex set of results from CSL, we believe it will take further time for the sector giant to demonstrate if it can again become an outperformer.