The Retail Sector prefers lower bond yields as most Australians feel richer and subsequently spend more across the board, a trend that is obvious but perhaps not as substantiated with less than 40% of Australians living with a mortgage!

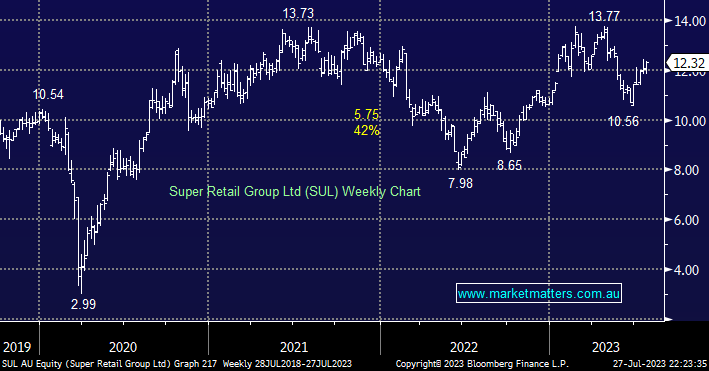

SUL remains our preferred pick of the Australian Retail Sector, having corrected -23% from its recent 2023 high with the operator of stores such as Super Cheap Auto, Rebel and BCF faring far better than many others in the space – this is definitely one area where we would prefer to buy relative strength.

However, we are conscious there is increasing evidence that the strong (for now) labour market & elevated household savings during COVID are no longer sufficient to offset the cost of living pressures which are rising & weighing on consumers, with spending now falling for a broader range of retailers. Hence we are cautious towards consumer discretionary retailers and have no exposure in our Flagship Growth Portfolio.

- We like SUL looking for a test of $14 while the stocks projected 6.7% yield over the next 12 months should help any inpatient investors but the upcoming results are a concern for us.