RMD fell over 2% on Monday following an update from Nasdaq-listed Dexcom (DXCM US). The US-listed stock plunged over 40%, its largest drop in history, after they reported disappointing revenue and lowered its full-year guidance. Dexcom offers a suite of tools, such as continuous glucose monitors, for patients who have been diagnosed with diabetes. Investors are clearly questioning whether the company’s performance was due to internal issues or more meaningful market changes, such as the surging popularity of weight loss treatments called GLP-1s. If the likes of Ozempic are hurting DXCM, the read-through is RMD could also struggle; considering the reaction by DXCM, we felt RMD delivered a stellar performance yesterday, while it’s US listed shares were up ~5% overnight.

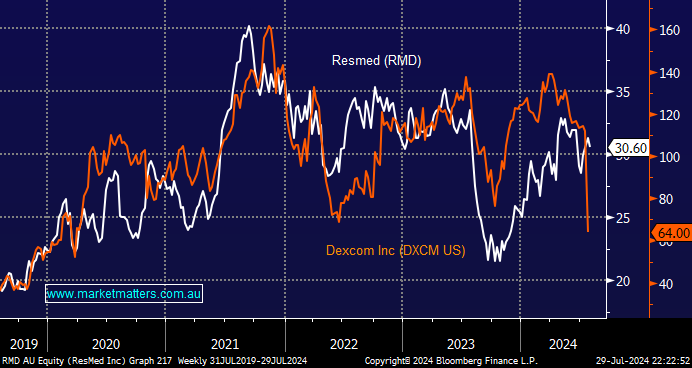

NB The correlation between RMD and DXCM has been close post-COVID.

- We regard stocks inversely correlated to the GLP-1 weight loss drugs, such as Ozempic, as “too hard” at this stage, as DXCM demonstrated on Friday night.