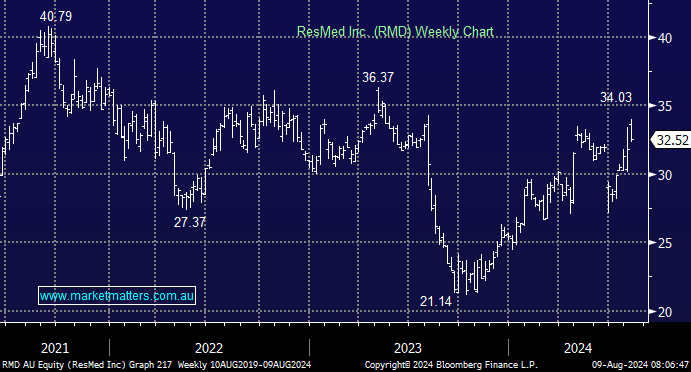

Sleep Apnoea company RMD has experienced a wild ride over the last year as news from weight loss companies has impacted its share price week to week more than specific news about the company itself. Earlier this month, RMD delivered a largely in-line 4Q, with revenue and core EPS both close to consensus. Revenue growth was 9% y/y and core EPS showed 30% growth y/y. At this stage, we think the long-term threat from GLP-1s for weight management is priced in the form of lower terminal growth than 18 months ago, but we expect ongoing volatility to provide buying opportunities for believers in the company along the way. Increased awareness of the importance of high-quality sleep via the likes of smartwatches should help RMD, but we are struggling to quantify medium-term demand.

EPS = earnings per share and y/y = year on year.

- We like RMD as a business, but future demand uncertainties make it “too hard” for MM, especially above $30.