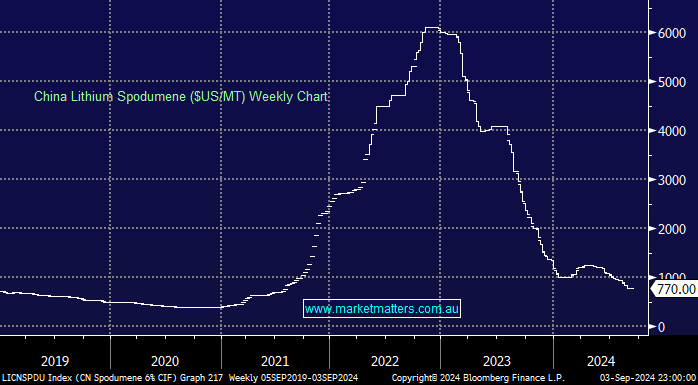

The lithium (Li) space has endured an awful time since early 2023, wiping out most of the gains since COVID. Good old-fashioned supply and demand have smashed the price of Li by around 90%, and although the exact pricing is a touch opaque, the trend is most definitely not. Over the last few months alone, we’ve witnessed prices drop another ~30%, posting multi-year lows in the process. Not surprisingly, MM has seen the number of questions on Li stocks dry up from a crescendo 18 months ago; perhaps our Q&A report could evolve its own oversold/bought indicator! Before we talk stocks, let first take a quick at the underlying supply and demand issue that has driven Li prices lower:

- Supply is increasing from several regions, including Australia, South America, and China, and lower prices only just starting to deter some companies, but overall, production is rising.

- Demand is dominated by the EV industry, particularly China, with global adoption continuing to track lower than many expected.

Another major concern around demand is potential tariff hikes from EU and US regulators retaliating against perceived Chinese dumping of EVs into the respective markets. However, for adoption to improve, we need EV prices to fall, and reducing competition with tariffs will have the opposite effect. Hence, markets are nervous about demand into 2025, driving prices even lower.

Several higher-cost miners have tried to reduce costs rather than meaningfully curb production, but this cycle is likely to pressure them further. The huge supply reaction to 2022 prices illustrates that there is plenty of Li available, and bringing it on stream isn’t too hard. However, it’s not necessarily economical, especially if demand doesn’t accelerate from current levels. There is a huge amount of “bad news:” already built into the Li price, and we would not be surprised to see it rotate in the $US700-1200 area moving into 2025, i.e. a relatively tight range compared to the last 18-months.

In June, we sold PLS for $3.50, a genius move if we had of also sold our Mineral Resources (MIN) position, which also carries Li exposure. Overnight, we asked ourselves whether we should exit MIN, an iron ore/lithium play, to focus on specific iron ore, say BHP, and lithium, say PLS, stocks—divide and conquer. This morning, we’ve focused on the Li side of the equation, and for reasons covered earlier, we only have interest in low-cost producers who, ironically, in the long run, could benefit from lower Li prices. As mentioned earlier, Li pricing/production isn’t as straightforward as gold and copper, but we are confident from a sheer price perspective that IGO is the best positioned, followed by PLS, especially when the latter ramp up production.

- The most readily available data shows production costs for IGO at $US220 and PLS at $US390. We will look at IGO later this week.

In August’s report, we saw that PLS looked in relatively healthy shape, with revenue of $1.25 billion and an profit of $256.9 million. Their cash balance was $1.6bn, with CAPEX reduced to $615- $685 million in FY25. Importantly, they also confirmed that their new concentrate plant at its Pilgangoora project is on budget and remained on track for completion in the 2025 financial year, which should significantly bring down their average cost of production. After their report, we held our neutral stance, seeing a limited downside below $3; if/when it takes another leg lower, it will be attractive from a risk/reward perspective, especially with a +20% short position likely to be getting twitchy in terms of taking some profit.

- The downside momentum and sentiment toward Li stocks is poor and a “washout” drop to ~$2.50 wouldn’t surprise us, an area where we again like the risk/reward.