As we wrote about yesterday in “The Match Out Report” a consortium led by aggressive alternative asset manager Regal Partners (RPL) and including private equity firm EQT have lobbed a very cheeky $30 bid for PPT, while we think the chances of success at that price are similar to winning last week’s $160mn Powerball, there is little downside for Phil King’s RPL in this foray with multiple angles at play.

- RPL has tossed the cat amongst the pigeons within the trading community, at the last count there was an 11.03% short position in PPT as traders bought PDL and sold PPT looking for a cheap entry into the post-takeover entity – a typical sort of arbitrage play.

- The Asian-based PE firm involved wants PPT’s trust business which is likely worth at least $1bn.

- If PE takes the trust business and Regal takes the funds business, RPL could effectively pick up ~$90bn of FUM for less than $500m – not bad considering RPL itself if worth ~$700m and is managing~$5.5bn!

The first thing that comes to mind is ouch, as PPT squeezed up +7.1% while PDL fell -10.67% – we feel there are a few more twists in this tale but in this section, we wanted to highlight two important points:

- Easy money often disappears very fast, especially in crowded trades/positions e.g. think tech and bitcoin over the last 12 months.

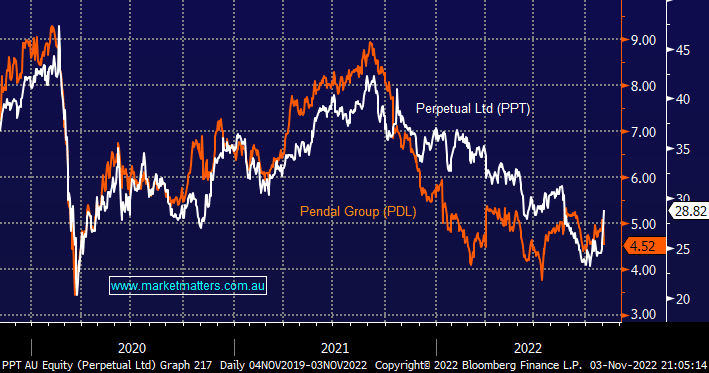

- Over the last 2 years PDL and PPT share prices have shadowed each other with yesterday’s move only likely to hurt the leveraged short-term players.