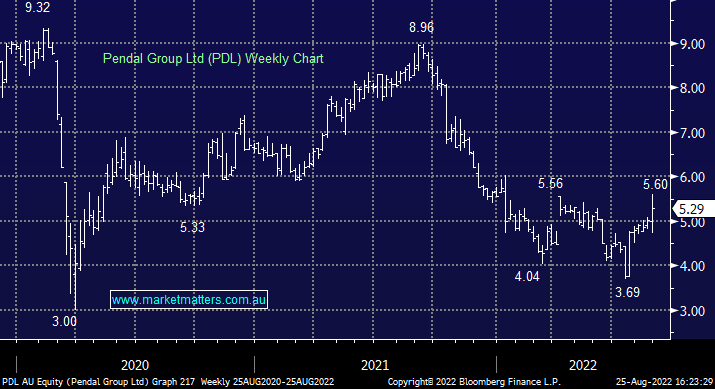

PPT -9.44% PDL +8.40%: The takeover took a more definitive step today as we thought it would on the day that Perpetual (PPT) reported FY22 results, which quickly became a secondary concern. The deal is framed as a takeover worth $6.016 for PDL based on yesterday’s close on PPT, however, as PDL shareholders, we’ll receive some PPT stock and some cash which at the closing price today is worth $5.635. The deal is 1 PPT share for every 7.5 PDL shares held plus a cash component of $1.976. For those inclined, the formula to use to trade the prices would be PPT stock price (27.44) / 7.5 + 1.976 = 5.6347. There is now an arbitrage opportunity for hedge funds who short PPT and buy PDL considering ~34.5c differential, however as shareholders in Pendal we simply need to ascertain the value in the combined entity from here. We think the deal makes sense, scale is important and the sum of the parts will be greater than the two separate entities as they stand.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains long PDL in the Income Portfolio – holding our position

Add To Hit List

Related Q&A

Perpetual (PPT) and Magellan (MFG)

Perpetual Ltd (PPT)

Perpetual Ltd (PPT)

GARY stocks

Perpetual Limited

Your view on several stocks

Analysis of WHC, BHP, and PPT please

Your comments on some stocks please

Fund Managers

MM should be helping Magellan (MFG)!

Can you explain the PPT/PDL pricing please?

Thoughts now on PPT and PDL

Thoughts on PPL’s takeover of PDL?

Why is Pendal (PDL) falling after PPT’s bid?

Is MM still happy with its PDL recommendation?

Is it a good time to consider any of the fund manager companies?

What does MM think of Perpetual (PPT)?

Clarifying MM thoughts on Pendal (PDL)

Targets for PPT, CPU & CSL

MM views on PDL

MMs view on MOC & PPT

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.