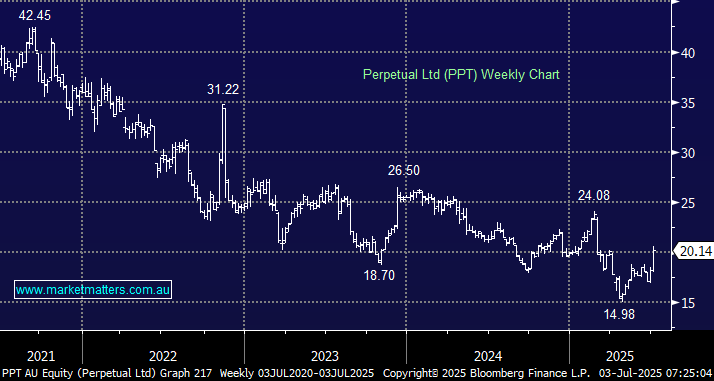

PPT soared 8.8% on Wednesday making it the best performing stock on the ASX200 although we must recognise it’s endured a tough few years, still trading more than 50% below its 2021 high. We believe PPT is oversold as the market punishes it for FUM outflows, which is understandable, and this may take time to reverse. However, its estimated 6% yield makes it easier to be a patient shareholder. Assuming markets remain buoyant, which has recently more than offset flow headwinds from an overall FUM perspective, we see value unfolding in PPT.

PPT is looking to sell its Wealth and Corporate Trust businesses, and the sale process for Wealth is currently active. The potential sale of Wealth would result in the net proceeds being used to deleverage the company, whose balance sheet is stretched following the Pendal acquisition. In 2025, PPT has been weighed down by the uncertainty of a tax liability, which remains an ongoing concern. Still, such situations often create opportunities when cautious investors base their valuations on worst-case outcomes. PPT is trading at a 12m forward PE of 11.7x, a 19% discount to its five-year historical average, providing a valuation buffer at current levels.

- We can see PPT squeezing towards the $22-24 area, which could unfold quickly if/when it sells its Wealth area.