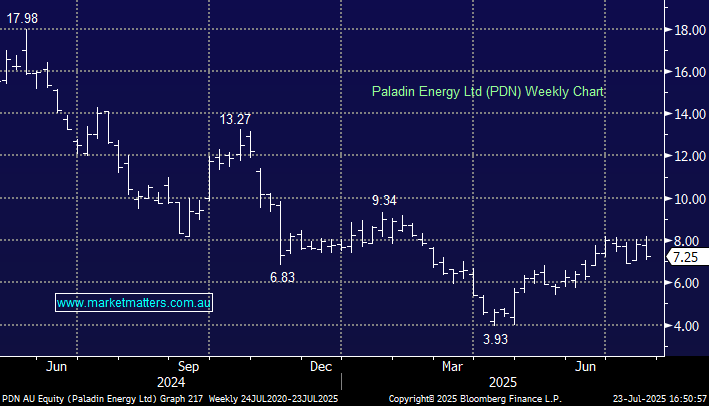

PDN -11.26%: The June quarter update showed a decent recovery given rain events earlier in the year, though the FY26 guidance disappointed and highlighted continued operational underperformance.

- June quarter production ~993klbs uranium (+33% QoQ) at US$37.5/lb cash cost

- Sales volume ~714,000klb, 280klb below production with a realised price US$55.6/lb

- FY26 production guidance: 4.0–4.4Mlb at US$44–48/lb cash cost

FY26 guidance came in well below expectations and implies a flat-to-lower run rate versus the current quarter, which was unexpected. This marks another misstep for Paladin (PDN), reinforcing concerns about execution risk and consistency in delivering operationally.