Happily, PDN resides in two MM portfolios, our question today is whether these holdings are big enough, as opposed to whether we should take profit.

- Flagship Growth Portfolio: we hold a 3% position here, which is large for this $2.8bn uranium business, considering it is only the 146th largest stock on the ASX200.

- Emerging Companies Portfolio: we hold a 6% position here, which is significant for the same reason mentioned above, although this portfolio generally carries a much higher Beta.

A dangerous word to use when investing, but MM is “comfortable” with our overweight exposure across these two portfolios to uranium via PDN.

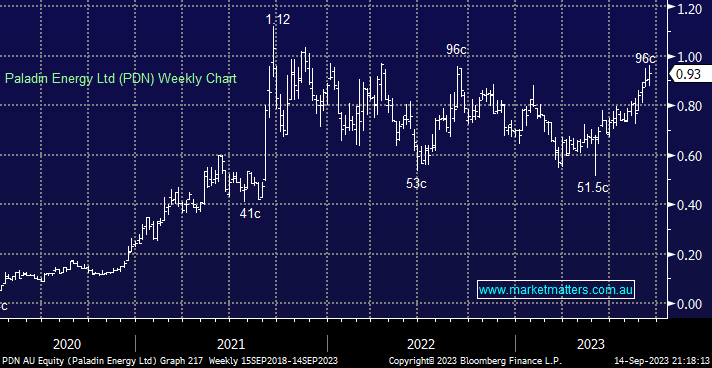

- We initially target the $1.20 area for PDN, another 25-30% upside.