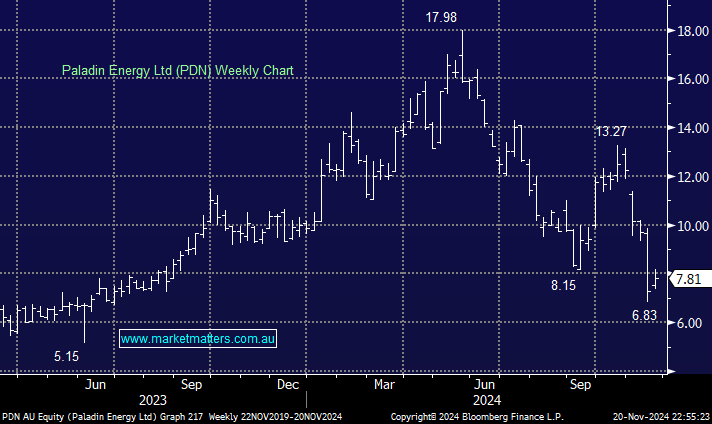

We have discussed PDN at length in recent days/weeks as the stock has become increasingly disliked; it now has a 14.4% short position, and only Boss Energy (BOE) at 15.2% is larger in the space. Uranium stocks are a love-or-hate basket; we, like Microsoft, believe nuclear will play a significant role in satisfying the “big techs” need for power to drive the massive adoption of AI. With the looming imbalance of uranium supply, MM has adopted a bullish stance toward uranium. However, the frustrating fact is that while Cameco Corp (CCJ US) in the US has surged to new all-time highs, PDN and the ASX names have struggled badly.

ASX-listed uranium stocks PDN and Peninsula (PEN) both recently announced production downgrades during the ramp-up period of their respective projects, which is frustrating at best. Whilst the news from PDN and PEN is disappointing, in our view, the market has overreacted to short-term issues which have not materially impacted the valuations of either company. PDN has witnessed its market capitalisation fall ~A$1.5b since the September quarterly, which is completely out of proportion to the actual value lost closer to A$60mn. In our view, the issues that Langer Heinrich has been facing are temporary and provide a great opportunity to acquire this battered stock.

- We will continue to like the uranium theme into 2025 and feel at current prices PDN is the best vehicle for “playing” such a stance.