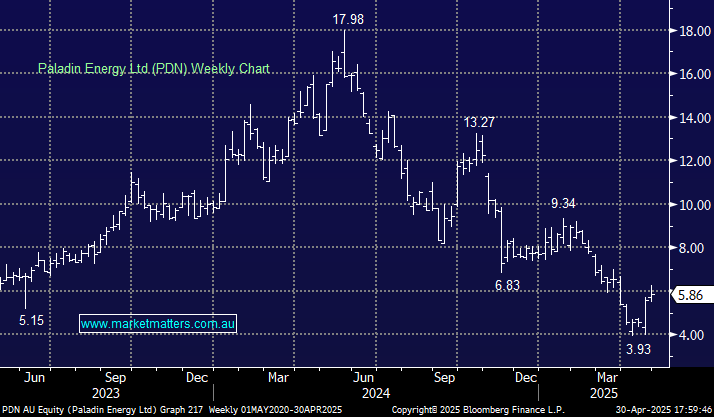

Market heavyweight PDN has been kinder to the shorts, declining over 20% so far in 2025 as the company has consistently disappointed operationally, including withdrawing guidance last month following heavy rain in Namibia. However, we can see the miner beating expectations and producing ~2.8 million lbs of uranium in FY25. With the stock priced to miss this, this could propel the stock significantly higher. In essence we believe the market has over-reacted to short term commissioning issues at Langer Heinrich.

PDN has finally started to deliver, last week it surged over 20% after providing a stronger-than-expected performance in the 3Q and giving comforting words around the impact of Trump’s tariffs: the company said that while recent US tariff hikes and global economic uncertainty caused market turbulence late in the period, the company has not experienced any direct impact on its operations, or sales. Production and sales were 28% and 43% of consensus forecasts, respectively, despite bad weather in the quarter. Their average realised price of US$69.9/lb was also a 7% beat, representing a 2% premium to the benchmark price, plus the cost of production was also 15% below consensus forecasts.

- We believe PDN is cheap and can see it initially testing $8 in the coming months: MM is long PDN in our Active Growth and Emerging Companies Portfolios.