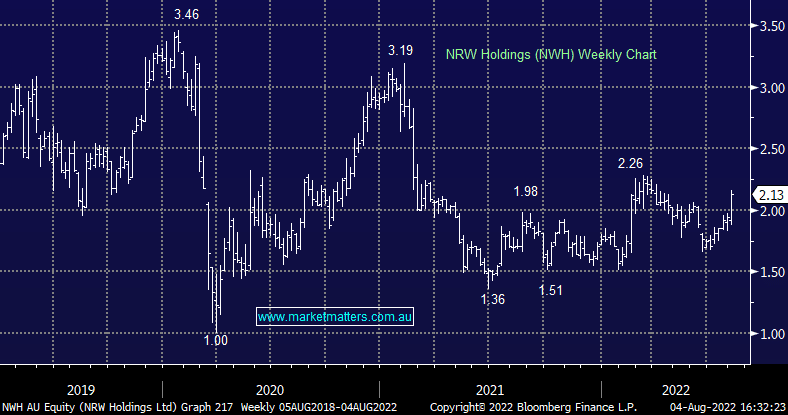

NWH +10.94%: The Perth-based mining & construction contractor was out with upgraded guidance today, with EBITDA now tipped to be $157m versus the prior guided range of $150-$155m. Revenue guidance remained at $2.4bn implying they’ve done better in terms of margins. More details to be provided when they report FY22 results on the 18th of August, however, suffice to say, this inexpensive contractor is priced on sub 10x earnings and is performing better than the market had feared.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes NWH around $2

Add To Hit List

Related Q&A

What to Buy/Accumulate

Buy/Hold/Sell

Profit Taking

Valuations

Should we ride NRW Holdings?

NRW Holdings (NWH) after a great AGM

What stocks would we top up here?

MM’s view on NWH

Why don’t we use stop losses?

Thoughts on NRW

Our view on NRW Holdings & Monadelphous Group (MND)

Why is NRW Holdings falling?

NRW Holdings (NWH)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.