NST caught our attention yesterday as it tumbled 4.7% in a strong market, making it the worst-performing ASX200 name on the day. This major gold producer has made the news on a couple of occasions in recent months:

- In December, NST agreed to acquire DEG in an all-stock deal worth A$5 billion. The acquisition enhances Northern Star’s production potential while addressing ageing asset concerns. NST has positioned itself to increase annual production to 2.5 million oz by 2029. At the time, the market reaction implied they had paid too much, but gold was trading ~$US2650; it doesn’t look too bad today, with gold over 25% higher!

- NST’s January quarterly report was lacklustre, garnering mixed reactions from brokers. The miner announced all-in costs (AIC) were A$3,278/oz in the December quarter, higher than a year ago due to capital growth projects, led by the KCGM Mill Expansion Project.

- Yesterday saw NST downgrade production by almost 5% while hiking its AISC by ~9%, sending the stock down nearly 5% on the day, although we note that most other producers finished lower.

The downgrade resulted from operational challenges at Kalgoorlie Consolidated Gold Mines, or KCGM, including delayed access to the high-grade Golden Pike North area. The company reported third-quarter gold sales of 385,441 ounces at an AISC of A$2,246/oz. It expects mining efficiency at KCGM to “lift significantly” in the fourth quarter, but we’ve heard such optimism in the past:

- This was the 4th consecutive year that costs have been missed for NST, with FY26 now set to miss.

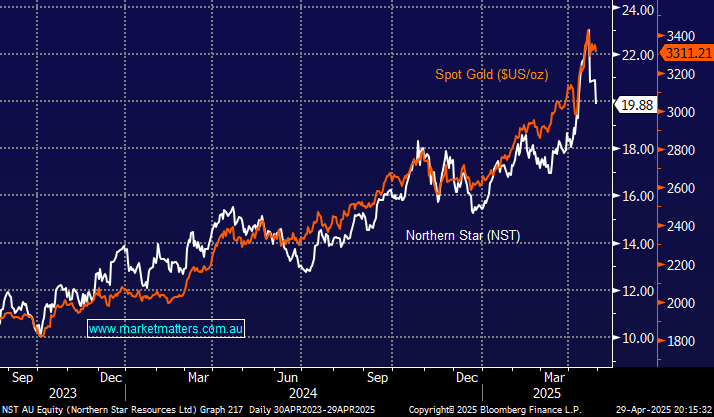

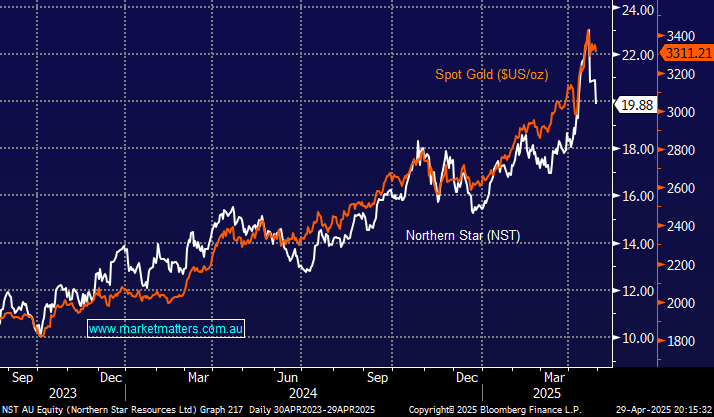

Over the last 18 months, NST has tracked the gold price very closely, but it’s started to underperform recently as the business struggles to deliver operationally. Many investors like MM are looking to increase their gold exposure in the coming months, but just because NST is looking cheap compared to gold doesn’t mean it’s time to elevate this miner to a top pick.

We prefer Evolution Mining (EVN) for gold and copper (25%) exposure as our “top quality” pick, and Regis Resources (RRL) for a leveraged, unhedged, direct play on the gold price. This view has us backing the top-performing stocks both operationally and in terms of price moves: So far in 2025, EVN is up +65%, RRL +77%, while NST has gained just +29%, obviously all great moves compared to the overall market – we are simply looking to buy the outperformers into a dip over the current weeks/months.

- We like NST due to its gold exposure below $19, but it’s not on our radar for the Active Growth Portfolio.