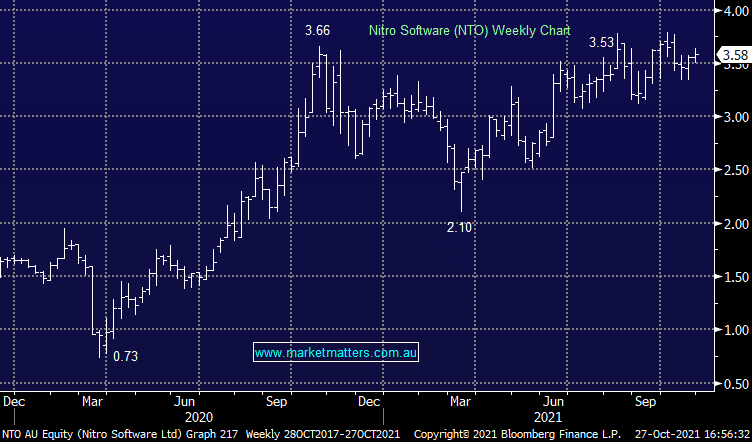

NTO +0.85%: Q3 update from the document productivity company was solid today and came with a small upgrade to guidance for the full year, helping to support the stock on a flat day. Subscription revenue was up 50% year on year, underpinning a 2-4% bump in FY21 revenue guidance to $US49-51m. Expected EBITDA loss was also lowered to under $US10m. The numbers showed Nitro are successfully transitioning sales to a subscription model which now comprises 68% of revenue vs just 56% in Q3 of FY20. A solid update, and in MM’s view with Average Reoccurring Revenue (ARR) growth set to underpin a likely re-rate in the share price given it trades at a steep discount to international peers.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish NTO

Add To Hit List

Related Q&A

What are MM’s thoughts towards Nitro Software (NTO)?

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Is it time to take tweak some positions?

Thoughts on Pointsbet & Nitro?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.