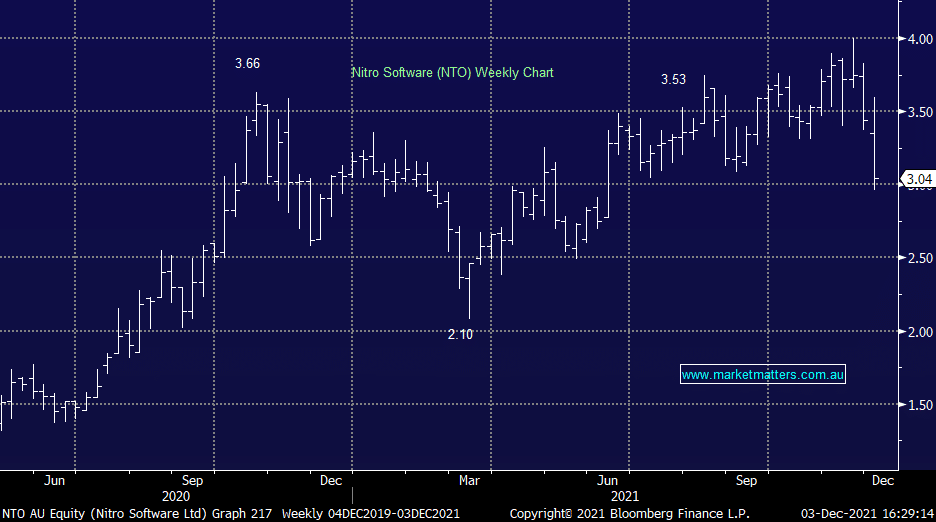

NTO -9.52%: tough day for the e-signature software business after competitor DocuSign (DOCU US) missed forecasts and was smashed aftermarket. The US based DocuSign gave 4th quarter revenue guidance of $US 557-563m, around 2.5% below consensus, though the stock was hit ~30% in aftermarket trade. The market was hyping up for a beat to estimates, but the supercharged growth of the last few periods looks to be tapering off. Nitro also saw selling pressure after the retail component of their recent equity raise closed a bit underdone. 4.4m shares were placed with the underwriter after around 40% of eligible shareholders took up their entitlement. It’s likely this will have some overhang on the stock into early next week, however we continue to like it and may add to the position into further weakness. It’s far cheaper than DOCU US and is gearing up after recent acquisitions.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is bullish NTO

Add To Hit List

Related Q&A

What are MM’s thoughts towards Nitro Software (NTO)?

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Is it time to take tweak some positions?

Thoughts on Pointsbet & Nitro?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.