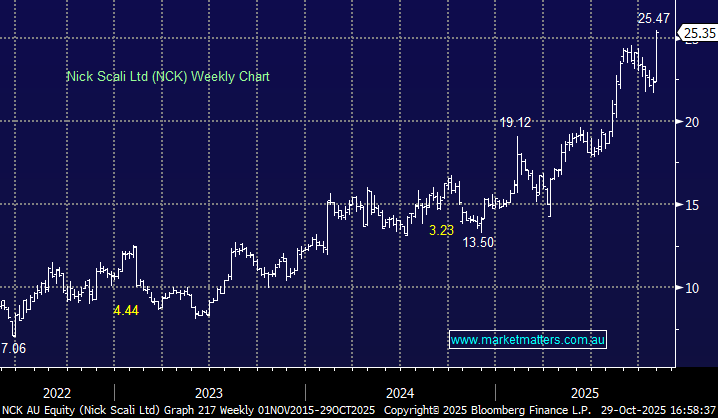

NCK +12.7%: Shares jumped to a fresh record high after the company’s AGM and trading update today, reporting an impressive 10.7% lift in ANZ same-store sales for the first quarter, signaling a strong start to FY26. This represents acceleration from July’s 7.2% growth reported in their last update.

- 1H Group NPAT expected at $33–35mn vs $30mn YoY

- 1H ANZ NPAT: $39–40mn vs $34mn YoY

- UK Operations expected statutory loss $5–6mn in 1H, with losses moderating in Q2

When we last wrote about Nick Scali in September, we highlighted its long track record of exceptional management execution, a strong balance sheet, and measured international expansion through Fabb Furniture in the UK. This update reinforces that view.

The core ANZ business is firing, order momentum remains robust, and early signs suggest the UK operations are stabilising. While valuation remains elevated after a strong rerating, earnings momentum and operational consistency continue to justify the optimism.