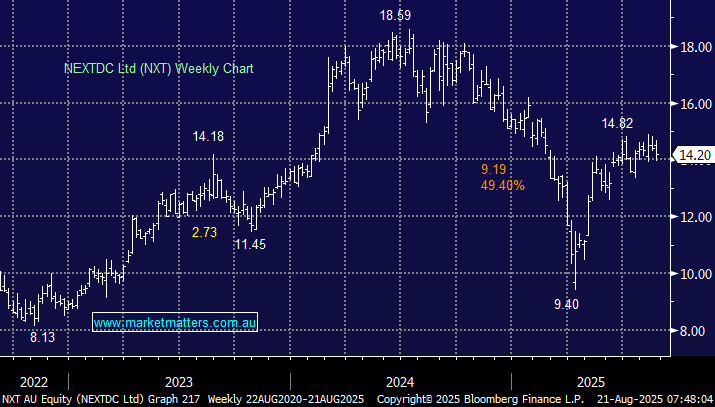

NXT has ridden the data centre (DC) roller coaster ride since mid-2024 having halved before recovering over half of the losses since its panic April low. We saw positive signs for the Australian DC operator in Google’s June-quarter update. Google called out capacity constraints even as its on-year cloud revenue growth accelerated to 32% from 28% three months earlier. The U.S. tech giant’s increased capital expenditure for 2025, and probably for 2026, is a positive demand signal for NXT, which is expanding beyond Australia – no US revenue yet.

This “picks and shovels” business of the AI evolution has faced a challenging 2025 as the DC sector adjusted its lofty valuations. Still, it strengthened its liquidity position by expanding its debt facility to $5.1 billion, avoiding a capital raise at low share prices. The stock rose on new DC contracts in June and a 7% increase in contracted utilisation, largely at its upcoming Kuala Lumpur facility, slated to open in early 2026. The company continues its expansion into New Zealand, Singapore, and Malaysia, benefiting from rising global AI and cloud demand. Valuation elasticity is the key to the DC stocks at present, or in simple terms, sentiment. We don’t see a potential landmine from NXT, but we know they will need more capital at some point. It’s hard to call it cheap around $14 as it’s enjoyed plenty of positive news on the demand side through 2025.

- We continue to prefer Goodman Group (GMG) for data centre exposure, but we do like leading players like NXT into dips – which may occur if they tap the market again.