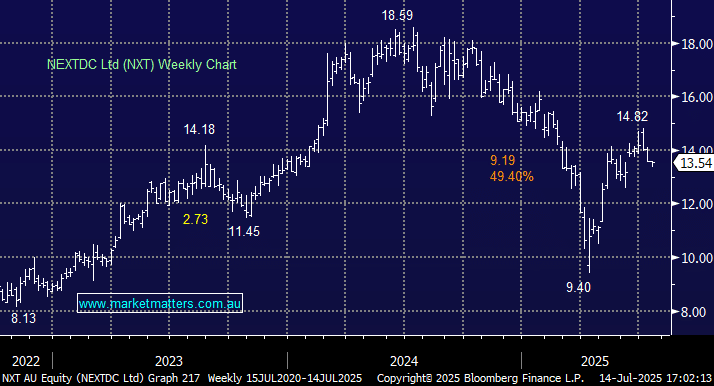

NXT has struggled through 2025 as reality crept into the DC space but NXT have forged ahead increasing its debt facility to $5.1bn in June, implying no cap raise at depressed share valuations. The stock jumped nicely in June after it announced new data-centre contracts and said its contracted utilisation increased across its network of centres by 7% between May 6th and May 31st. The bulk of the recently contracted space was at the Kuala Lumpur centre, which is expected to open in early 2026. The Australia-based company is expanding to New Zealand, Singapore, and Malaysia amid growing global demand for AI and cloud computing. We think the DC washout is behind NXT, much of which was triggered by GMG’s capital raise, and we may reconsider NXT into weakness.

- We can see NXT slipping back under $13, but like the market, we believe it’s a stock to “buy the dip”.