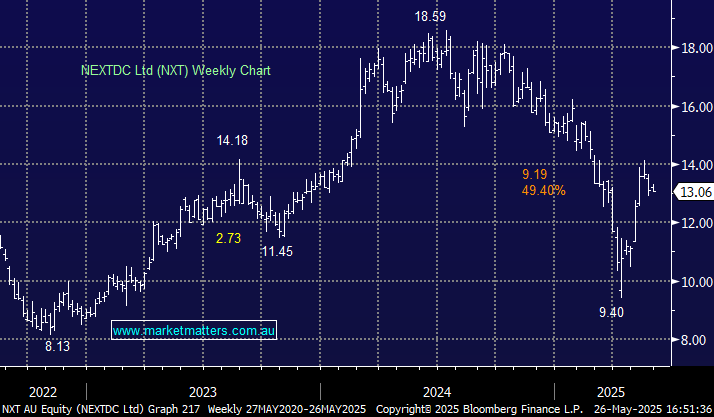

NXT plunged almost 50% from its 2024 highs as the original major ASX Data Centre (DC) player found itself fighting for investors and potentially funds as GMG and DGT provided new local competition in the space. The risk continues to hang over NXT of another capital raise as they race to maintain their expansion plans; the company already executed two in 2024 and one in 2023, with DC expansion being a capital intensive operation.

However, with the stock back at ~$13 raising money should be easier but its not a bullish backdrop for the stock. Additionally, NXT disappointed the market in February after missing estimates with its contract utilisation numbers, and it will need a better set of metrics when it reports in August. UBS remain bullish on NXT, saying that valuation concerns are overblown, considering the amount they have already invested for future growth. UBS have a Buy at $19.80 PT.

- We are net positive NXT as it operates in the DC space which we like, but we prefer GMG for exposure at this stage.