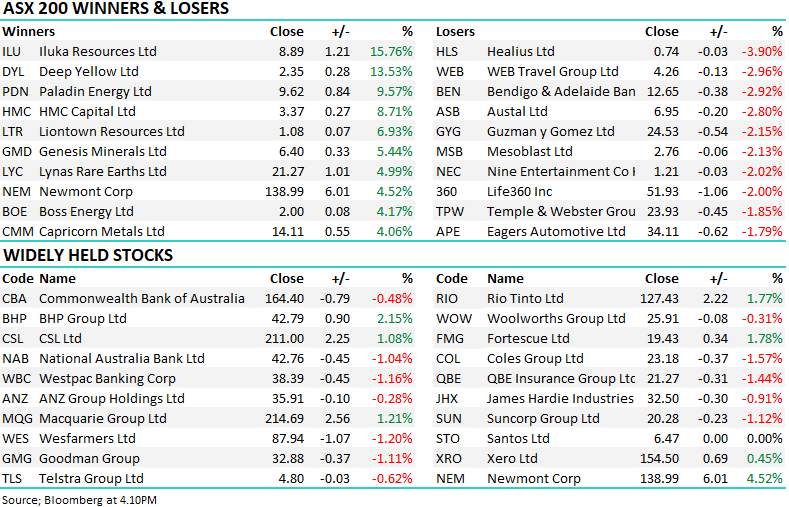

Newmont is the world’s largest gold company, aided by its recent purchase of previously ASX-listed Newcrest Mining (NCM); it currently has a market cap of ~$US40bn. If we had known where gold would be trading a few years ago, it would have been easy to lose money in many gold miners, including Newmont, which can now also be bought on the ASX using the Newmont Corp CDI’s (NEM). At MM, we are bullish on gold through 2024/5, although it is likely to be a choppy journey; the question is, where can we get decent risk/reward exposure to gold, looking for lower interest rates moving forward?

- We like the risk/reward on Newmont into fresh multi-year lows, or 5% lower in the US market, i.e. a potential replacement to our recently sold Northern Star (NST) position for when we want to increase our gold exposure.