NEM has significantly underperformed the gold price and its sector peers over the last five years, partly due to poor performance compared to guidance, i.e. markets hate misses. However, we now believe guidance is achievable, and this will drive positive operational momentum vs what’s priced into justifiably sceptical investor sentiment/positioning, i.e. given its operational performance in recent years, the de-rating is understandable, but there’s now plenty of “bad news” already built into its price. Also as an added tailwind, we anticipate US$2-4bn of divestments over the next 12m to accelerate deleveraging & cash returns.

NEM is set to have one of the best portfolios in the gold industry, comprising predominantly large, long-life assets in low-risk jurisdictions and attractive brownfield growth projects. If NEM can rebuild investor confidence, it can again attract a valuation premium instead of today’s discount. However, NEM doesn’t screen overly cheaply compared to its peers; hence, without an operational turnaround, it will struggle. On cue, in April, NEM had a decent operational start to the year, where CY24 guidance was retained with a stronger 2H still flagged.

- We think NEM is an excellent risk/reward opportunity for bullish gold exposure as investors remain largely disbelievers. We are looking for a 25% upside in the medium term.

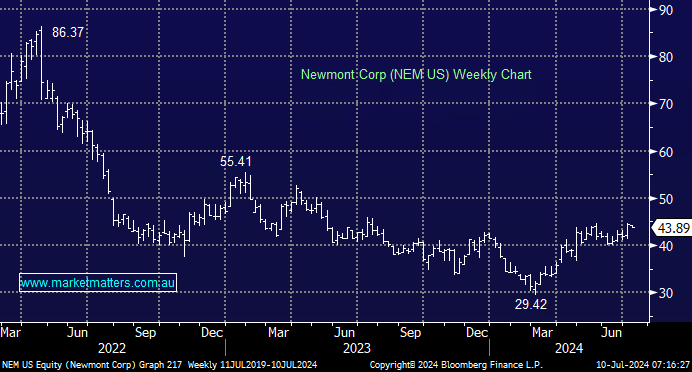

NB: We have used the chart of NEM in the US below as the Australian equivalent has only been trading for a few months.