We recently took profit on our second foray this year into Evolution (EVN). We flagged the move over recent months, and when gold broke above $US3500, we took our money again with EVN having been a very profitable hunting ground for MM, as has the gold sector in general for most investors. Continuing from comments around gold earlier, we need to be open-minded that we may have exited our precious metal exposure too early, and if so, how/where will we look to re-enter?

Upgrades have flowed through the market in recent weeks, with Goldman’s now talking a potential move to $US4500, or 18% higher, and UBS a more conservative $US3900. The story remains the same, with falling interest rates and geopolitical uncertainty driving the precious metal ever higher. Local gold stocks largely disappointed across the board in the latest reporting season, on a combination of modestly weaker production, higher costs and higher growth capex – Vault (VAU) joined this week, receiving downgrades as a result. Firstly, we ask what’s priced in:

- We believe some equities appear fully priced or have even become rich, with value increasingly concentrated towards the mid-cap names such as Genesis Mineral (GMD) and Perseus (PRU).

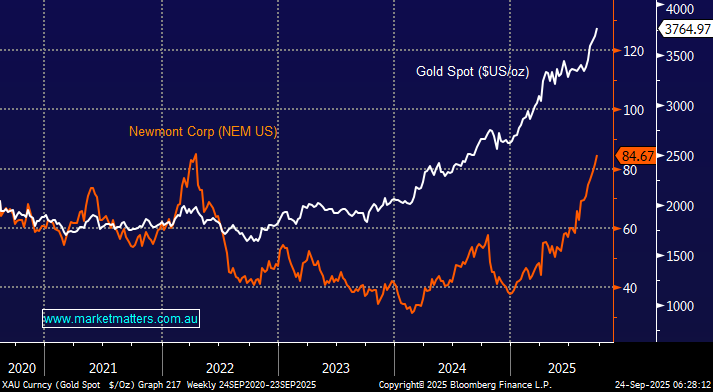

However, today we have focused on the world’s largest gold stock, Newmont Corp (NEM US), which is now also quoted on the ASX since its takeover of old local favourite Newcrest Mining (NCM). So far this year, it’s up +112%, outperforming many of its local peers, aided by ETF buying – according to ETF tracker, as of mid-August 2025, an estimated $US44 billion globally had poured into gold ETFs, with heavyweight Newmont front and centre of their shopping list as we touched on earlier.

Newmont (NEM) is our preferred large-cap gold producer, well ahead of Northern Star (NST) as it enters a new phase of high capex growth. NEM’s key features are steady production, a strong balance sheet and nice cash returns:

- Continued success with non-core asset divestments allowed NEM to add another US$3bn buyback in July, helped by net debt well below targets.

We can see strong support on pullbacks during a seasonally strong period for physical gold markets, as both investors and physical buyers are likely to step up during dips. NEM endured a tough few years, significantly underperforming the gold price from mid-2022. This has turned around in 2025, and we believe it has further to go with natural support, such as the large buyback.

It may surprise many to know that NEM is still cheap on a historical basis and we can easily justify a $140-150 price target if gold simply holds current levels. NEM reported strongly in July sending the stock up to a 3-year high with free cash flow of $US1.7bn for the quarter. No concerns at this stage that the ASX names have experienced from higher cash costs with inflation of ~5%, and elevated sustaining capex. There’s a strong chance that MM will “go big” when it re-enters the gold market moving forward.

- At this stage, we are keen buyers of NEM in the $115-120 region.