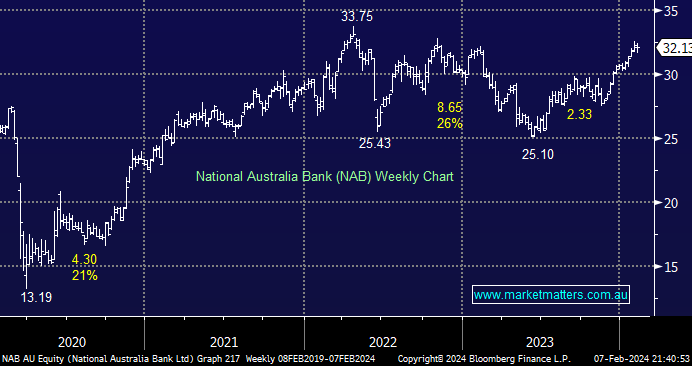

NAB closed down -0.2% after highly-regarded CEO Ross McEwan announced his retirement, with Andrew Irvine, who currently heads its business and private banking, set to take the reins in April. The announcement hasn’t altered our view towards NAB, with it remaining one of our preferred “Big Four” plays alongside ANZ Group (ANZ); encouragingly, the market appeared to agree as solid buying emerged into early weakness under $32. With its May dividend looming on the horizon, we believe the stocks can remain firm through 1H – current estimates are for NAB to pay 91c fully franked and for thee stock to yield ~6% over the coming 12-months

- We remain comfortable with our NAB positions in both the Active Income Portfolio and the Active Growth Portfolio.