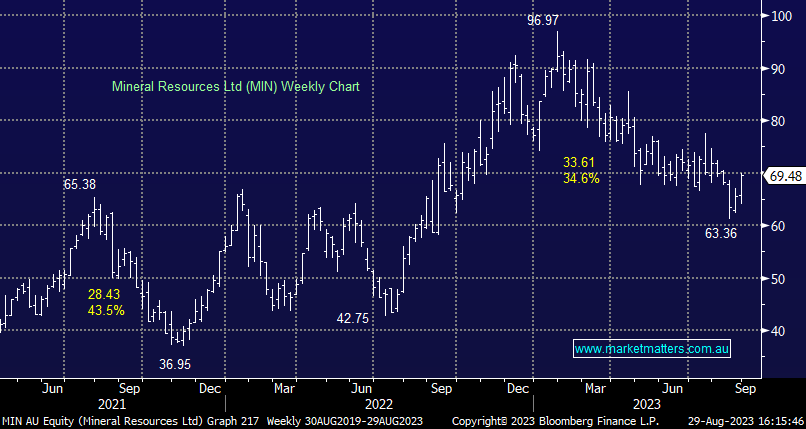

MIN +7.97%: We covered Mineral Resources (MIN) this morning (here) with the result a beat at the profit line by ~6%, however the quality seemed to be low and the higher than expected dividend was a strange one given the uplift in capex guidance for the year ahead. Most brokers saw it as a mixed result at best and by in large, the notes reflected that, but the share price didn’t – the Chris Ellison effect! We like and hold MIN in the Flagship Growth Portfolio backing them to successfully use revenues generated in Iron Ore and mining services to execute on their Lithium ambitions, and while short term challenges will come up, if they get this right, and we expect they will, MIN it worth well north of the ~$70 it’s trading at today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is long & bullish MIN

Add To Hit List

In these Portfolios

Related Q&A

Mineral Resources Ltd (MIN)

The taking a loss lottery

Where would you buy Mineral Resources (MIN)

Views on MIN, AGL, & IPL

Is it time to buy the fall in quality mining stocks &/or GQG following their latest FUM nos

Thoughts on Mineral Resources (MIN)

When do you give up on Min Res?

Mineral Resources

MIN, MP1

Energy & mining stocks

Dollar cost averaging

MIN / IPG

Resource stocks are a hard call at times!!

MIN – Compelling buy?

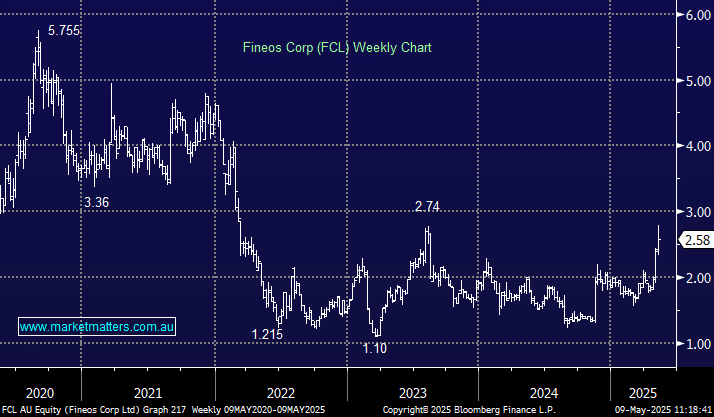

Update on FCL, FSLR, SLX and some lithium stocks

PLS: a buy at these levels?

Allkem thoughts on risk/reward below $9.50

Iron Ore Producers

Does MM like Lithium and its respective stocks?

MIN US bond issue at 9.25%, can I get some?

Thought on MIN’s 14% Stake in Delta Lithium (DLI)

What are MM’s top picks for resources exposure?

When does MM decide to sell?

Could Mineral Resources (MIN) demerge moving forward?

JIN & MIN – part 2

MIN

Thoughts on Lithium & Gold

Our view on Mineral Resources (MIN)

Strandline (STA) capital raise & Mineral Resources (MIN)

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.