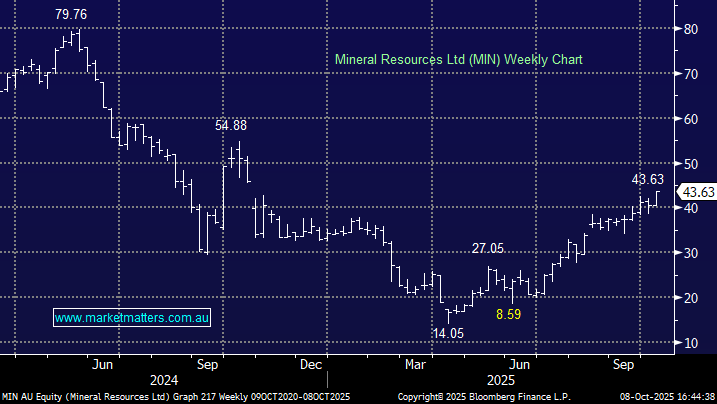

MIN has surged around 80% in the last three months, dancing in sync with lithium names such as Pilbara Minerals (PLS) even though in FY25, MIN only generated around 14% of its revenue from lithium. The shorts are getting squeezed as the price and fundamentals improve for MIN – more than 10% of MIN is still held short, although the professional traders are clearly buying, with this down from 15% in June. After wearing lots of pain from our MIN position, it would be easy to cut out at breakeven, but we see more upside and intend to “let it run” at this stage.

- We are initially targeting the $50 region for MIN in the coming months/quarters: we hold MIN in our Active Growth Portfolio.