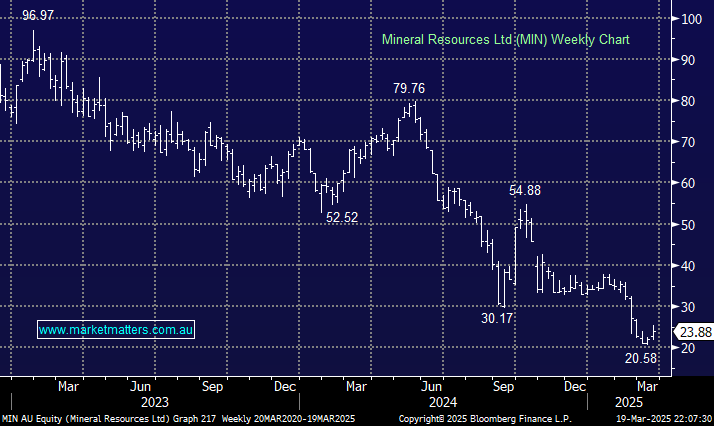

MIN got smacked ~13% on the open again on Wednesday after the crash of an iron ore truck, which caused haulage on its Onslow iron Haul Road to be paused for a couple of days. We hear this was very much driver error, and frankly, with so many truck movements along the road each day, these types of incidents are bound to happen. However, the news compounded the already poor sentiment surrounding Founder Chris Ellison and high debt levels, but encouragingly, unlike most times over the last two years, investors bought the dip, allowing the stock to recover most of the knee-jerk weakness and close down less than 4%.

We believe MIN has reached peak net debt, with a slower yet unmistakable deleveraging of the balance sheet in the medium term, without the need for a capital raise. There is enormous upside rerating potential for MIN with analysts pricing in a ~20% decline for iron ore in the next 2 years and only a limited recovery in the Li price, allowing plenty of room for an upside surprise, which in part could come in the form of renewed optimism towards EV take-up and Li prices.

- The market loved MIN at ~$80 and hates it at ~$20. We think the right price is somewhere in the middle —MM holds MIN in our Active Growth Portfolio.