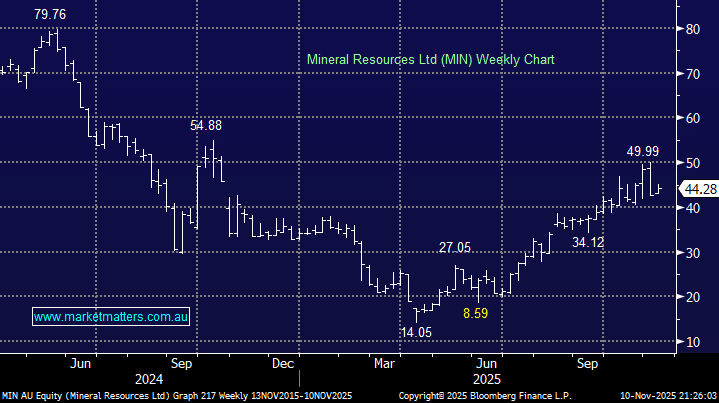

Monday was case of two out of three’s not bad for MIN with its lithium and mining services divisions delivering strong tailwinds while iron ore has weighed slightly over the last week. However, the stock still advanced over +4% on Monday with fresh 2025 highs looking likely if our bullish outlook for Li proves on point – MIN still has an almost 7% short position, but notably it’s more than halved since June.

- We continue to see a test of the $52-4 area for MIN as investors chase Li and mining services exposure – MM owns MIN in the Active Growth Portfolio.