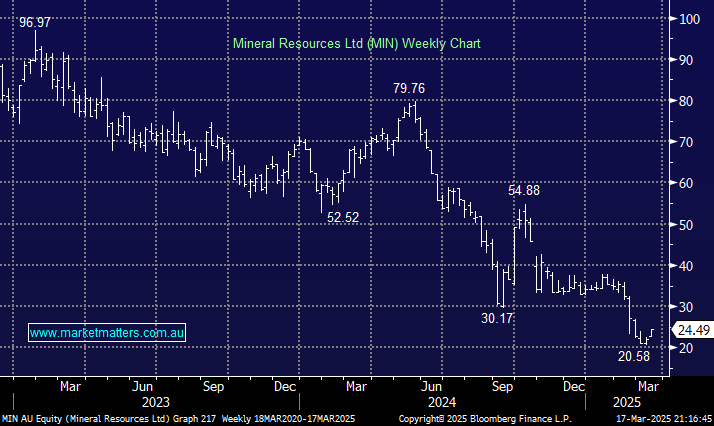

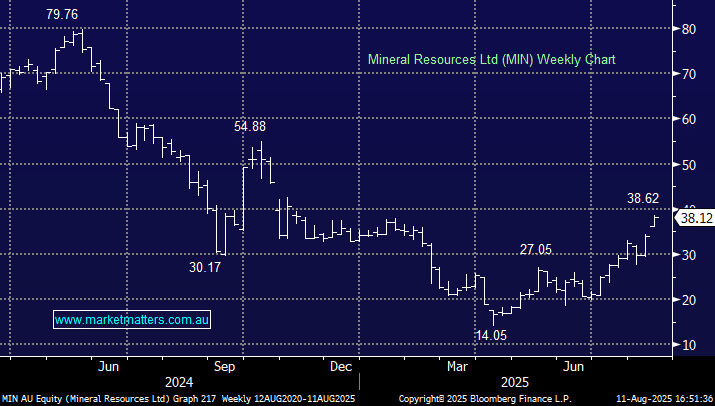

MIN surged +11.6% on Monday after UBS did an about-turn toward the beleaguered miner, reversing its Sell call to a Buy. Their previous Sell rating was based on MIN’s high operational and financial leverage to its underlying commodities (iron ore and lithium) when the outlook for both was average, which dragged many related stocks lower. Valuing MIN comes with plenty of assumptions around commodity prices, but we estimate MIN is pricing in US$80/t iron ore and US$1,300/t spodumene SC6.0, leaving plenty of upside surprises moving forward. Its mining services business will also help cash flow in the coming years. Importantly, we believe MIN is “peak debt”, and this market concern will improve moving forward without a capital raise.

Regarding the other elephant in the room, Chris Ellison et al. While issues aren’t fully resolved, we believe the picture should improve from here, although it will remain in the back of investors’ minds through much of 2025/6. MIN is a leveraged play on iron ore and Li with a few cobwebs attached, but as China starts to fire, it could easily surprise on the upside.

Worth noting that we’ve now seen multiple brokers upgrade MIN in recent weeks, the cynic would suggest this could be pre-empting a capital raise i.e. brokers with a positive rating are more likely to get a mandate. We are conscious of this, however, if they did press the button and raise equity, it would take one important component of the bearish thesis off the table.

- We can see MIN testing $30 this FY, but the ducks will need to align for it to push toward $50 in the short term: MM is long MIN in the Active Growth Portfolio.