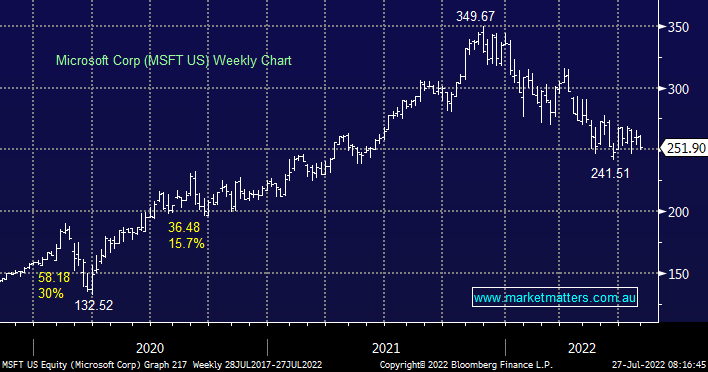

Microsoft has been a phenomenal success story over the past 15 years and more importantly for MM, has been a core portfolio holding since the onset of Covid in 2020, currently showing a paper profit of ~50% in two years. They reported quarterly results overnight that were weaker than expected with both revenue and earnings slightly below most analysts’ expectations, the higher $US the primary reason this multinational goliath missed. Revenue of $US51.87 bn was behind Refinitiv derived consensus of $52.44bn (-1%) and earnings missed by a similar quantum – the first time that has happened since 2016, although if we strip out the impact of the currency, it was in line with expectations – shares were down 2.4% and another 1% after hours. One aspect that caught MM’s eye was slight softness in cloud revenue, with growth coming in slower than expected. It’s important to remember ‘variability’ is part of the cloud alure, and that can work against and for the vendor, a concept that should be considered when thinking about other cloud businesses both here and abroad.

We hold 9% of the portfolio in this position and have the intention to reduce it to make way for a smaller allocation to a higher risk, higher return stock called Snowflake (SNOW US), which is actually involved in cloud-based data. As we all move into the cloud, having a great platform that facilitates collaboration, data engineering and many other key aspects in a highly secure and governed way is increasingly important, however as suggested above, cloud earnings can be more variable so expect more volatility from a position like this.