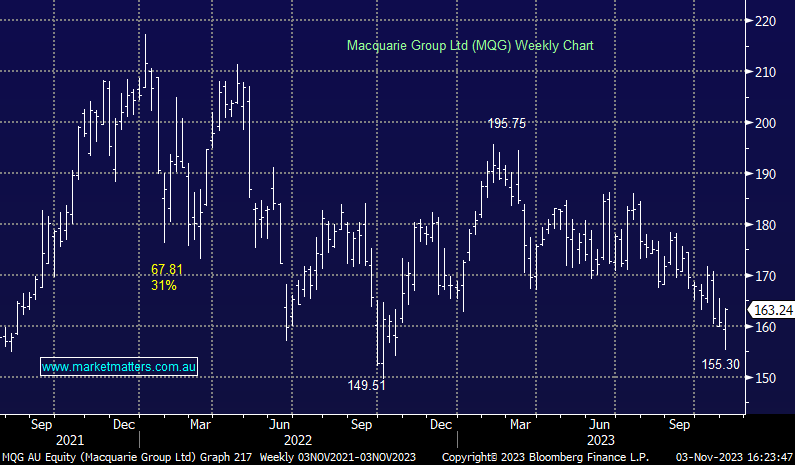

MQG +1.78%: A softer-than-expected 1H24 result today driven mainly by weaker performance from Macquarie Asset Management (MAM) – net profit of $1.42bn was below consensus of $1.69bn and they declared an Interim dividend of $2.55, ahead of the $2.25 expected. While their overall guidance for the year suggests some stabilisation in 2H earnings, and the approved on-market share buyback of up to $2bn is very supportive, the result was a miss and should lead to downgrades.

That said, MQG sees the market like no other, and when they conclude that allocating $2bn towards their own stock is the most compelling use of capital, we should take note, and that is what happened today. A tough period for them clearly, however they are a quality franchise, highly leveraged to improving markets, and we remain holders of the shares in our Growth Portfolio.